Do the markets dance?

Luigi Campopiano

In the markets in 2022, financial conditions have been tight around the world and things are now undergoing similar pressures to a continental drift along the lines of what we saw with Pangea, a super continent that existed up to 300 million years ago.

The Fed has announced a change in its monetary policy, the European Central Bank has aligned itself, and the People’s Bank of China lowered rates in the face of the slowdown in its economy. Meanwhile, the central banks of England and many emerging countries have already made several rate hikes.

These movements of the various "tectonic plates" in the world of finance — American, European and Asian — are generating instability. The flare-up of inflation, the increase in rates, the economic slowdown in China, the high levels reached by some markets and the explosion in the price of raw materials.

And 2022 immediately records the earthquakes resulting from this new situation. We are in a correction phase for the S&P 500 and the European stock exchanges, with a downward movement between 10-20%. On the NASDAQ, we are already in a bear market phase, with a downward movement of over 20%.

How long will this continental drift last? Volatility always destabilizes most savings despite all the good intentions made at the time of the investment. Volatility also arrives in the quieter bond market, with the German Bund returning to positive territory after about three years being underwater.

Since March 2009, the lowest peak reached by the markets after the Lehman crisis, this downward movement is ranked number 26, an average decline in the order of 7.6% and three peaks in 2011, 2018 and 2020 of 20% and more. Although the market has scared us several times, this has not prevented it from rising from 666 points on March 6, 2009, to 4,397 on January 21, 2022.

My advice may sound familiar: Do not let yourself be guided by fear but follow the investment plan drawn up at the beginning. Trust in the historical ability of the markets to reward long-term investment, the only bulwark against short-term volatility.

Related articles

Related articles

Editorials 15 September 2023

The first reaction during a period of high market volatility could be to panic. But it’s better to avoid that and to instead plan.

Editorials 26 May 2023

A financial professional's proven ability to build client confidence and help them stay invested can be considered invaluable, especially in these exceptionally challenging times.

Long live simplicity

In the life of someone who is trying to save money for the future, mistakes can be made. After all, we all make mistakes in life.

Editorials 30 December 2022

From the point of view of savings and investments, this means bringing added value through choices which appear illogical in terms of achieving what is shared. ...

Editorials 02 December 2022

If we focus on portfolio choices, we should avoid reacting with fear to what could be short-term market factors.

Read more

Read more

Implantology 03 February 2026

Bone Structure, Metabolism, and Physiology Its Impact on Dental Implantology

When placing implants in the mandible or maxilla, it is important for clinicians to understand the process of bone remodeling, the different types of bone, and how these factors can affect the...

Editorials 03 February 2026

Dr. Alireza Sadr of the Department of Restorative Dentistry has been appointed as the first-ever UW School of Dentistry Director of Digital Dentistry and Innovation, effective Jan. 1, 2026.

Products 03 February 2026

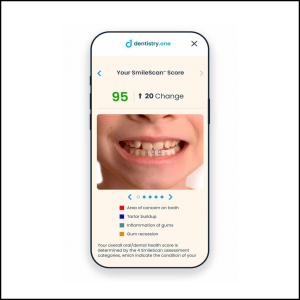

Families can now use SmileScan™, a free, AI-powered oral health scan offered by Dentistry.One, to identify potential areas of concern and receive an overall oral health score.

Investment supports professional growth for future oral health leaders and expands community outreach for underserved Oklahomans

News 03 February 2026

Henry Schein, Inc. (Nasdaq: HSIC), the world’s largest provider of health care solutions to office-based dental and medical practitioners, announced recently that it will release its fourth quarter...