Financial advice and trust

Luigi Campopiano

When measuring the value of financial advice, the return on assets under management is not the only yardstick, nor the most important one. When the markets generate uncertainty and volatility, the value of wealth management is identified in the strength of the relationship of trust created between individuals and investments. A financial professional's proven ability to build client confidence and help them stay invested can be considered invaluable, especially in these exceptionally challenging times.

Most research outlines costs and benefits, both real and perceived, of professional financial advice has often focused on the quantitative aspects of the latter. For example, research often points to the performance achieved by the managed portfolio or the ability to generate returns of its instruments.

A client’s relationship with investments cannot be traced back to the analysis of numbers and graphs alone, as a key role is played by the management of their emotions. Knowing how to speak to emotions is an important skill that requires a consultant to have a deep knowledge of the financial and private life of his clients. A strong relationship of trust must be created between clients and the professional, both towards professional competence and, more generally, towards the investment sector itself.

In a study, "An Investigation of the Relationship Between Advisor Engagement and Investor Anxiety and Confidence," conducted in 2020, professionals wondered whether, beyond performance, investors who are guided by an advisor feel more confident in making important financial decisions compared to those who are not followed by a professional.

The study confirmed a positive relationship between advice and trust and found that respondents who used a financial professional were twice as confident in their ability to achieve their investment goals than those who did not. a professional.

The current economic context is a perfect example of how fundamental the role of financial advisors is in strengthening the confidence of their clients in their investments to help them maintain a firm focus on their long-term goals. Confidence is a significant factor in a saver's willingness to stay invested even in the toughest market conditions. The advice of an experienced professional, who can evaluate the current environment in a prospective way, can help to eliminate some of the emotions related to investing. This advice can also be fundamental in helping investors pursue their life goals in the long term.

An additional example is the persistence of inflation which increases investors' fear of losses and can push them to assume irrational behavior. This might include disposing of their investments perceived as riskier, in favor of greater liquidity, which is perceived as safer.

This is contrary to good financial practice, which would instead envisage investing in assets whose return is potentially capable of exceeding inflation.

Setting goals and having the confidence to pursue them are important aspects of the consultant-client relationship. It is essential that an investor who is considering whether to start or continue a path with a financial advisor understands that the potential positive impact of the latter on their investment confidence must undoubtedly be included in the cost-benefit analysis.

Related articles

Related articles

News 10 February 2025

Envista Holdings Corporation announced that the company will hold a Capital Markets Day on Wednesday, March 5, from 9:00 AM to 12:00 PM EST.

Market 29 November 2024

In financial markets, the butterfly effect is not uncommon—a phenomenon where small changes in conditions can lead to significant long-term variations in a system's behavior.

News 08 November 2024

The Belle Époque was a historical period characterized by economic growth, technological and scientific advancements, and significant improvements in living conditions, particularly for the...

News 09 August 2024

Over the past 15 years, Wall Street has dominated the global scene. The Morningstar US market index (including large, medium, and small companies) has more than quadrupled in value.

News 24 May 2024

Software of Excellence Partners With Pearl to Deliver Dental AI to the UK and Asia-Pacific Markets

Pearl announced that Software of Excellence, a leader in dental software, has selected Pearl as its new, exclusive dental artificial intelligence (AI) provider.

Read more

Read more

Implantology 03 February 2026

Bone Structure, Metabolism, and Physiology Its Impact on Dental Implantology

When placing implants in the mandible or maxilla, it is important for clinicians to understand the process of bone remodeling, the different types of bone, and how these factors can affect the...

Editorials 03 February 2026

Dr. Alireza Sadr of the Department of Restorative Dentistry has been appointed as the first-ever UW School of Dentistry Director of Digital Dentistry and Innovation, effective Jan. 1, 2026.

Products 03 February 2026

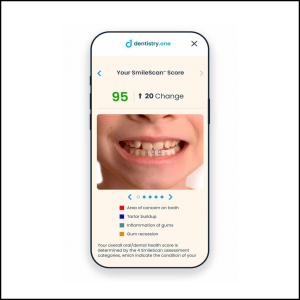

Families can now use SmileScan™, a free, AI-powered oral health scan offered by Dentistry.One, to identify potential areas of concern and receive an overall oral health score.

Investment supports professional growth for future oral health leaders and expands community outreach for underserved Oklahomans

News 03 February 2026

Henry Schein, Inc. (Nasdaq: HSIC), the world’s largest provider of health care solutions to office-based dental and medical practitioners, announced recently that it will release its fourth quarter...

.jpg)