The CAP is what is needed to manage volatility stress

Luigi Campopiano

The three steps identified by the Stanford University Mind & Body Lab to manage negative emotions that can affect our life choices are: recognizing, welcoming and using stress to your advantage.

If we focus on portfolio choices, according to the experts of Janus Henderson Investors, we should avoid reacting with fear to what could be short-term market factors. The instrument best suited to assist investors in this may be the CAP, or the capital accumulation plan, defined as a tax-assisted group investment or savings plan that allows a person to decide between two or more investment options offered within the plan.

Since the beginning of 2022, financial markets have been characterized by a high level of volatility, fueled by economic and geopolitical problems. In the U.S., one of the fastest 10% declines in history occurred, as the S&P 500 index took only 15 trading days to drop at that rate.

This level of volatility is nothing new. It has been seen before and will be seen again. However, while history has shown this to be true, it remains unpretty to experience, especially when it directly affects assets.

More than 60% of investors admitted that they have made an impulsive or emotional investment decision that they later regretted, according to a survey conducted in 2021 by CNBC.

Numerous studies have shown that investors have historically made these decisions at the wrong time, meaning they bought at the high point and sold at the market's lows.

A market decline can fuel fear of loss, which can lead to financially poor decisions. In many cases, people know that they should avoid making emotional decisions with their financial planning, but they do it anyway because taking action allows a person to feel as though they had some level of control.

Controlling your feelings and ensuring they don't push you to make any significant moves with your wallet is important regarding your financial health. Despite short-term volatility or market headwinds, long-term returns on most asset classes between 2001 and 2020 have been positive, according to JP Morgan data from December 2021.

The negative feelings that accompany monetary volatility and loss are important to acknowledge and manage. Systems and processes need to be set up to ensure we avoid making bad decisions. Recognizing and welcoming stress allows you to take a step back from your emotions while using stress allows you to shift your attention to wondering how to exploit it to your advantage.

In a volatile market, stress can help you focus on aspects of your financial plan that can and should be improved. This includes reviewing your financial plan and goals or rebalancing your portfolio to ensure it is adequately diversified.

A CAP allows investors to better navigate volatile periods. It is an investment strategy for today, tomorrow and for the future because it allows a person to create a system that can help them resist the emotional ups and downs of the market.

Related articles

Related articles

Market 02 November 2022

The capital accumulation plan can be compared to a piggy bank which, when we open it, will hold more money than we put in since there will also be capital...

Editorials 06 January 2023

A good way to start succession planning is to begin with a simple check of your financial position

Editorials 26 August 2022

COVID has had a big effect on our lives in many ways - one of them is financial planning, which is true for most retirees. At the beginning of the pandemic, many monetary institutions introduced...

News 30 October 2025

GTCR, a leading private equity firm, announced the simultaneous signing and closing of a strategic, structured minority investment in Solmetex (the “company”).

vVARDIS, a Swiss high-growth dental company, and OrbiMed, a leading healthcare investment firm, recently announced the closing of a $35 million financing.

Read more

Read more

Implantology 03 February 2026

Bone Structure, Metabolism, and Physiology Its Impact on Dental Implantology

When placing implants in the mandible or maxilla, it is important for clinicians to understand the process of bone remodeling, the different types of bone, and how these factors can affect the...

Editorials 03 February 2026

Dr. Alireza Sadr of the Department of Restorative Dentistry has been appointed as the first-ever UW School of Dentistry Director of Digital Dentistry and Innovation, effective Jan. 1, 2026.

Products 03 February 2026

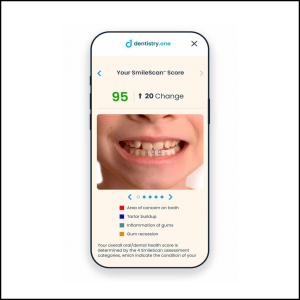

Families can now use SmileScan™, a free, AI-powered oral health scan offered by Dentistry.One, to identify potential areas of concern and receive an overall oral health score.

Investment supports professional growth for future oral health leaders and expands community outreach for underserved Oklahomans

News 03 February 2026

Henry Schein, Inc. (Nasdaq: HSIC), the world’s largest provider of health care solutions to office-based dental and medical practitioners, announced recently that it will release its fourth quarter...