In finance, simplicity wins

Luigi Campopiano

Being able to simplify is very complicated, but it helps achieve objectives in many cases. If you try to subtract, you inevitably assign an increasing degree of priority to the priorities themselves, adding real value to what remains on the table.

From the point of view of savings and investments, this means bringing added value through choices which, at first sight appear illogical in terms of achieving what is shared. But these choices prove successful tomorrow: choices in finance take on a meaning full of expectations and are almost devoid of risks, at least in the collective imagination. Volatility, for example, allows you to increase the volume of your investments over time and is perceived downwards: when the value of your position is lower than in the past, you think you have suffered a loss.

We tend to think in frames when the investment is a dynamic path. The time factor will always be essential to manage emotions during phases of high market volatility through shared and shareable choices.

It's not simple because if it were, financial education and advice like behavioral advice probably would never have been the subject of many analyses, projects and interventions by institutions and other sectors. Simplifying concepts should be the guideline for industry insiders to propose new methods in interpreting and considering the investment approach. Listen to the doubts that regularly arrive, experimenting with new analogies as examples to be developed in the future.

Devise simple examples that can help us achieve the main objective of our business, which is to avoid those typical mistakes in financial choices. We could add value while subtracting errors by simply multiplying.

As an example, the repayment of the value of an investment that lasted decades has two options:

- Option A. The daily credit of $10,000 for 30 days.

- Option B. The daily credit of $0.01 doubled every day for 30 days.

The choice is between simple or compound capitalization; these choices appear counter-intuitive and lead to diametrically and exponentially opposite results. The example intends to place maximum attention on how the result achieved over time (theoretically for an indefinite duration of investments) generates such a volume that the simple contribution of customer subscriptions will never be able to equal.

Comparing a credit from $10,000 against one cent seems a paradox, but in the "how" we approach the choices, the "why" of the results we want to achieve are hidden.

The attention always paid to "what to invest," "what to get," and "what to do" inevitably distracts: supporting the saver in the transition from "what" to "how" and "why" and opting for a method rather than for a product will always be a good alternative solution to procrastinate the duration of investments year after year.

Which option would you choose and why?

Related articles

Related articles

Editorials 15 September 2023

The first reaction during a period of high market volatility could be to panic. But it’s better to avoid that and to instead plan.

Editorials 26 May 2023

A financial professional's proven ability to build client confidence and help them stay invested can be considered invaluable, especially in these exceptionally challenging times.

Long live simplicity

In the life of someone who is trying to save money for the future, mistakes can be made. After all, we all make mistakes in life.

Editorials 02 December 2022

If we focus on portfolio choices, we should avoid reacting with fear to what could be short-term market factors.

Market 21 October 2022

In the markets in 2022, financial conditions have been tight around the world and things are now undergoing similar pressures to a continental drift along the lines of what we saw with Pangea, a...

Read more

Read more

Implantology 03 February 2026

Bone Structure, Metabolism, and Physiology Its Impact on Dental Implantology

When placing implants in the mandible or maxilla, it is important for clinicians to understand the process of bone remodeling, the different types of bone, and how these factors can affect the...

Editorials 03 February 2026

Dr. Alireza Sadr of the Department of Restorative Dentistry has been appointed as the first-ever UW School of Dentistry Director of Digital Dentistry and Innovation, effective Jan. 1, 2026.

Products 03 February 2026

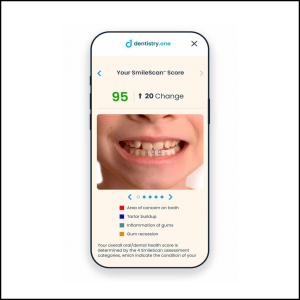

Families can now use SmileScan™, a free, AI-powered oral health scan offered by Dentistry.One, to identify potential areas of concern and receive an overall oral health score.

Investment supports professional growth for future oral health leaders and expands community outreach for underserved Oklahomans

News 03 February 2026

Henry Schein, Inc. (Nasdaq: HSIC), the world’s largest provider of health care solutions to office-based dental and medical practitioners, announced recently that it will release its fourth quarter...