Don’t panic, plan it

Luigi Campopiano

The first reaction during a period of high market volatility could be to panic. But it’s better to avoid that and to instead plan.

Various events can cause market fluctuations. You cannot control how these forces end up affecting it, but measures can be taken to mitigate their impact on the portfolio of investments. One of the best ways to manage the impact of market volatility is to create and stick to a diversified and risk-adjusted investment plan.

If you have already created this type of a plan, you could consider reviewing it to see if you need to make any changes to achieve your financial goals. It is important not to make rash decisions during periods of high market volatility.

Here are some tips that may be helpful:

- Find risk tolerance. All investments involve a certain degree of risk, and it is useful to establish your risk tolerance. When developing the investment plan and you consider the risk, you must think about the objectives and the investment experience, the time horizon, the current financial situation and loss aversion. For example, if you must withdraw money from investments first, you could consider more prudent investments as you may not have much time to wait for a market rebound. Everyone has different risk tolerances and only the investor, you, can decide what is best for your financial future. Additionally, when you create the investment, it is important to put money aside in something less risky that will allow you to access money at any time in case of need for unexpected challenges of life.

- Diversify. "Don't put all your eggs in one basket." Distribute the investments in a mix of asset classes and include different types of investment products in the portfolio to reduce the risk and impact of volatility on the overall portfolio. Diversification within an asset class is also important.

- Do not try to “time” the market. During times of high volatility, initial reactions could be the sale and exit from the market. But most plans of investments are created long-term, allowing investors to not be distracted from short-term market fluctuations. If possible, it is useful to continue investing according to your investment plan. Even when the market swings up and down, consider using an investment strategy that makes you buy more when the market goes down. A mistake you might make is to sell when the market falls, because it can often be the best time to buy. Not everyone can do it, but it is something to take advantage of if you can. It's time in the market, not the timing of the market which leads to long-term investment success. When you create an investment, it must be done with an understanding based on objectives and tolerance to risk, so that you can continue to follow it during periods of market volatility.

- Investing in the future. Even during a period of market volatility, it is important to continue to contribute to your retirement plan. It is useful to maximize any employer contributions because no one investment will provide that kind of guaranteed return. Contributions to some of these plans are fiscally facilitated. If money is limited, it is useful to consider reviewing your current budget to see if you need to make changes or realign priorities. You must decide if it makes sense to reduce the amount of money you spend in a particular category, to continue to allocate funds for retirement. Saving for retirement and investing in the future is always a good idea, regardless of market conditions. Everyone knows what they can afford, and you can work to achieve long-term financial goals.

- Pension. Sometimes market downturns come at the most uncomfortable times. As you approach retirement it is useful to evaluate if you need to make changes to your investment plan to meet financial needs (e.g., switching from more aggressive to more prudent investments). Making these types of adjustments before retirement can help protect your portfolio from market volatility.

- Stay calm and stick to the plan. With the right investment plan, you should not need to make rash decisions during periods of market volatility. Consider long-term financial objectives and risk tolerance. Managing a portfolio of different assets will better prepare you for inevitable market changes.

Related articles

Related articles

News 30 October 2025

GTCR, a leading private equity firm, announced the simultaneous signing and closing of a strategic, structured minority investment in Solmetex (the “company”).

vVARDIS, a Swiss high-growth dental company, and OrbiMed, a leading healthcare investment firm, recently announced the closing of a $35 million financing.

Smile Partners USA (“Smile Partners” or the “company”), a portfolio company of Silver Oak Services Partners LLC (“Silver Oak”), announced today a strategic investment from a new...

Market 29 November 2024

In financial markets, the butterfly effect is not uncommon—a phenomenon where small changes in conditions can lead to significant long-term variations in a system's behavior.

Their gift is the latest for the Power of 1,000 Campaign, which aims to raise $1 million for the mobile clinic to allow for treatment to even more underserved communities across Southern California.

Read more

Read more

Implantology 03 February 2026

Bone Structure, Metabolism, and Physiology Its Impact on Dental Implantology

When placing implants in the mandible or maxilla, it is important for clinicians to understand the process of bone remodeling, the different types of bone, and how these factors can affect the...

Editorials 03 February 2026

Dr. Alireza Sadr of the Department of Restorative Dentistry has been appointed as the first-ever UW School of Dentistry Director of Digital Dentistry and Innovation, effective Jan. 1, 2026.

Products 03 February 2026

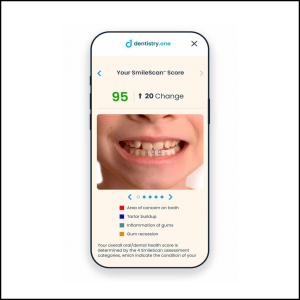

Families can now use SmileScan™, a free, AI-powered oral health scan offered by Dentistry.One, to identify potential areas of concern and receive an overall oral health score.

Investment supports professional growth for future oral health leaders and expands community outreach for underserved Oklahomans

News 03 February 2026

Henry Schein, Inc. (Nasdaq: HSIC), the world’s largest provider of health care solutions to office-based dental and medical practitioners, announced recently that it will release its fourth quarter...