Interview with Roberto Rosso, President of Key Stone, an international consultancy specializing in market studies in the dental sector

In what situation is the Spanish market in 2023, with the pandemic already behind us? Have we already recovered?

Apparently yes, because we have had very good results in terms of implant volumes. The market grew by 30% in 2021 after the decline in 2020, and in 2022, it also grew significantly. If we add up the volume of these last three years, we practically recover the half million implants lost in 2020. During this time, the market has indeed grown, but we have had about 500,000 implants that have not been placed in the mouths of Spaniards, and now all this growth is almost a physiological rebound from what was lost. It's worth noting that the market in 2022 was close to 1.9 million implants, and this figure will be surpassed in 2023. It is a very high number at the European level and certainly in comparison with the rest of the world.

According to your market analysis, what variables are decisive for this growth in implant volume that is being observed?

Over the years, we have seen a popularization of implantology, with people being well aware of implants. This is also due to an oversupply, largely due to corporate dentistry, increasing awareness of the treatment type. People have lost fear and prefer a fixed and permanent rehabilitation over time.

But there is a very important phenomenon that has intensified after the pandemic, due to the increase in life expectancy. A child born in 2019 has 18 more years of life expectancy than their grandfather born in 1950, leading to increased concern for health, not only physical but also social and psychological. This leads to an older population over 60 seeking more aesthetic and long-term treatments. Therefore, we are witnessing a decrease in treatments with removable prosthetics and an increase in fixed prosthetics and implants. Digitalization also aids in this trend, as treatments become more predictable, reflecting in market studies.

Have you analyzed how the penetration of digitization is reflected in the evolution of the implant market?

So far, we have not yet conducted a correlational analysis between these two factors. We see that digitization is increasing, as evidenced by the use of intraoral scanners, with around 40% of dental clinics using them. In 2024, we have Expodental, and we will see a significant sale of technology in 2022; in 2023, sales have remained stable, growing moderately, but we have higher expectations in 2024. However, we need to differentiate between using intraoral scanners and complete clinic digitization. Applying a technique or tool, such as an intraoral scanner, is one thing, while fully digitizing the clinic is another. We are conducting a pilot study in Italy, and we plan to conduct a similar study in Spain, France, Germany, and the UK in 2024.

Is the implant sector currently focused on aesthetics or the rehabilitation of people with significant deterioration?

In our analyses, we can see that the pursuit of aesthetics is prevalent among the younger population, a more "hedonistic" vision, giving importance to being liked by others, a more social perspective. However, after the age of 50, the focus shifts to self-care to feel good about oneself. Therefore, aesthetics does not always purely relate to social integration or being socially accepted.

If we look at the industry, we observe that companies operate in different price ranges. What is your analysis of the market focusing on the implant cost variant?

At Key Stone, we segment brands based on price, positioning, and their involvement with the scientific community. We break this down into four typologies: Discount and Value, which are below 80/90 euros per implant, don't provide much clinical support. Then there are Access Premium companies, which have clinical studies and offer courses but also have an affordable price and are already recognized brands in Spain. Finally, there are Premium brands, which are the four or five most recognizable companies worldwide. We observe that Access Premium and Premium companies, although they also compete with offers and prices, maintain their market share. In the Discount category, they have lost sales because most clinics do not trust very cheap implants.

How does the significant presence of corporate network clinics influence the market?

It is important because it represents around 30% of the implant market. Corporate dentistry doesn't always use Discount or Value products because they also save by using Access Premium or Premium. They have contractual power, and within this world, some companies prefer to use unknown products, while others prefer branded products for more confidence and positioning. It's a significant market that changes its trend, as we've noticed with some companies disappearing due to the impact of demand for these products, although they are now recovering from this.

In relation to your international analysis, how does Spain differ from other countries like Italy?

All countries, like Spain, that experienced a decline, are recovering almost at the same level. Some are behind in volumes, such as France, where the market is growing more due to the organic demand that needs to be recovered. It is clear that Spain is a mature market, and we cannot predict significant growth. In a significant study we are conducting with a sample of 450 implantologists, most of them anticipate a market that is the same or with growth of approximately 4%. In France, slightly higher growth is expected. It's important to emphasize the target of people over 70 who are opting for a better quality of life and want permanent rehabilitations. This is a crucial group that needs attention.

Next year is Expodental, the most important fair in the sector in Spain. Is such a fair decisive for the market's evolution in terms of promotions, discounts? Does it influence the market?

Yes, it influences a lot, but we have to distinguish between consumable products (like implants) and technologies. Even though offers are made, as in 2022, and even if half a million more implants are sold, they still need to be placed in patients' mouths; otherwise, they stay in dental clinics' drawers. Sales can be made, but they are somewhat momentary and make no sense throughout the year. It's different with technologies because it's a good opportunity to renew and introduce new technologies into dental clinics, taking advantage of the structural impact in this regard. Regarding the sale of more implants, it may happen that between March and May, 200,000 more implants are sold, but in the next quarter, these are implants that are no longer sold. Therefore, Expodental has a very significant impact on modernization and providing better service to patients as dental clinics become more modern and technologically advanced.

Related articles

Related articles

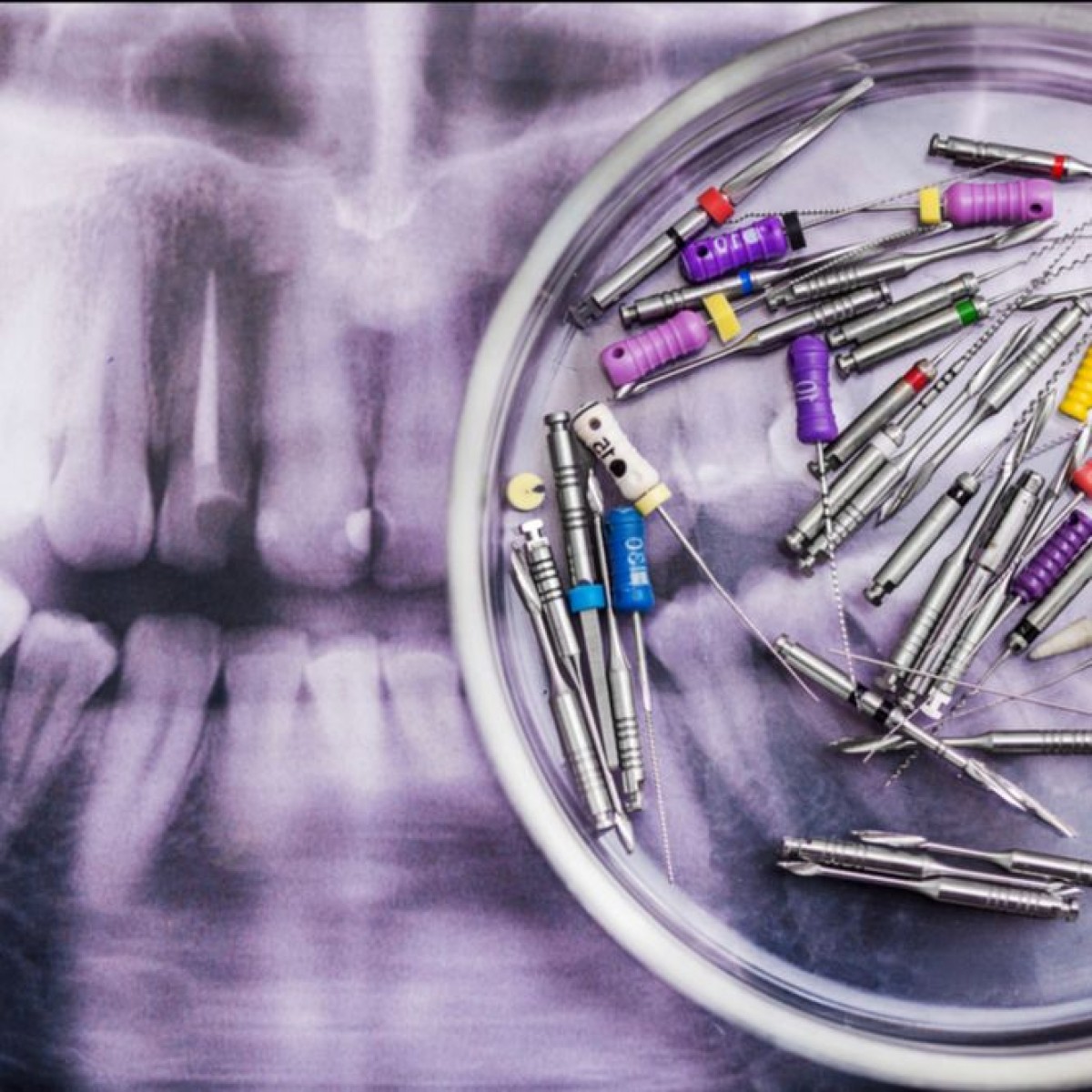

Dr. William Nudera, author of “NuEndo: rethinking endodontics,” by Edra Publishing spoke with Dentistry33 at the American Association of Endodontists 2023 annual meeting in Chicago. In the...

Digital Dentistry 13 April 2023 - 30 November -0001

In this interview, Giacamo Anselmo, director of sales and marketing for 3D Systems Corporation, discussed his role with the company and its impact on the dental ...

Digital Dentistry 12 April 2023 - 30 November -0001

Video: Gianfranco Berrutti, advisor, National Union of Italian Dental Industries (UNIDI)

Berrutti is currently an advisor to UNIDI and previously served as its president. He also has a leadership role with Major Prodotti Dentari, one of the...

Anderson is currently the solo practitioner in his dental practice. He has 12 people on his dental team, and they make the practice run, he said. The team...

Campbell said dental students spend at least four years learning about how to do dentistry, but almost no time learning how to get paid to do dentistry.

Read more

Read more

Periodontology 14 November 2025

This study was carried out to assess the oral hygiene awareness and practices amongst patients visiting the Department of Periodontology at Gian Sagar Dental College and Hospital, Ramnagar (Patiala).

Editorials 14 November 2025

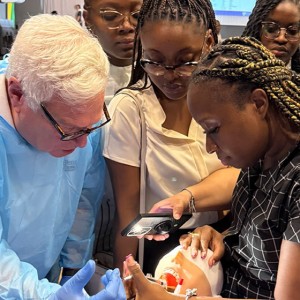

Penn Dental Medicine shared its expertise in caring for persons with disabilities with dental care providers from throughout Jamaica at a 1 ½ -day hands-on continuing education program, held October...

News 14 November 2025

Dr. Thomas M. Paumier, a dentist in Canton, Ohio, is the new President-Elect of the American Dental Association (ADA). Dr. Paumier was elected at the ADA House of Delegates meeting in Washington,...

News 14 November 2025

Premier Dental Implants & Prosthodontics is proud to announce the opening of its newly renovated dental office and the launch of its new website

News 14 November 2025

Henry Schein One and AWS Collaborate to Transform Global Dentistry with Generative AI

Industry leaders join forces to bring advanced AI capabilities to dental technology platforms — redefining patient care, clinical efficiency, and practice performance worldwide