Financial Advice That Has Worked for 300 Years

Luigi Campopiano

Five academics have undertaken the task of reading and synthesizing three centuries of financial advisory history into a new literary effort that represents the "summa" of financial advice: "Invested: How Three Centuries of Stock Market Advice Reshaped Our Money, Markets, and Minds." Considering the authors' conclusions, these might be the last 382 pages worth reading on the subject: because in the last three centuries, the main arguments on how to invest have not changed much.

Each publication on the "secrets" to successful investing revolves around the same concepts: on the other hand, the demand from readers wanting to understand "how to get rich" through investing has never waned. Usually, the number of "operational" publications dedicated to the markets increases when interest rates are low. The reason is simple: if low-risk returns (current account and/or short-term government bonds) are high, there is less need to get involved with riskier assets like stocks or private equity. If the choice is between no return and a high exposure to equities (as has been the case for much of the post-2008 period), then the demand for information on how to navigate the markets increases. Yet, the approaches of those teaching personal finance remain largely unchanged.

Here are the recurring principles of investment guides since the 18th century:

- In the field of stock investment, it is better to prefer shares of high-quality companies at reasonable prices and sell them when they are no longer so, without being influenced by emotions (the rule underlying so-called value investing);

- Ignore short-term forecasts. The chances of missing a forecast are extremely high, especially since market behavior often changes with completely unforeseen events, or at least contrary to expectations;

- Think long-term. It's not difficult to earn in the markets. What is difficult is resisting the tempting urge to squander money in short speculative operations for immediate gains (economist Burton Malkiel, author of the classic "A Random Walk Down Wall Street") — an obvious lesson, but often ignored;

- Diversify. It is a strategy practiced since the beginning (in 1849 T.S. Harvey wrote in his "What Should I Do with My Money" to "not be content with a single safe investment").

For 300 years, financial advice has been repeated with few changes, but the effort necessary to effectively convey these messages never seems sufficient. The problem is that putting good financial advice into practice often proves problematic, much like following a healthy and balanced diet. Excessive confidence or suspicion easily distances one from the expected economic results from investments, even when the "right" books have been read.

In these 300 years of manuals on learning to invest, many have "sold" harmful and misleading fantasies, with unrealistic visions of easy profits and the certainty of success, trying to hide the fact that there is no formula to avoid life's uncertainties and economic calamities.

Related articles

Related articles

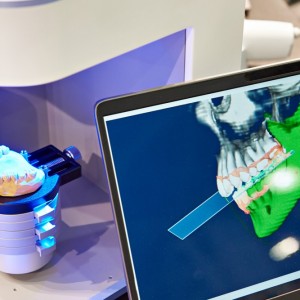

Dentsply Sirona, the world’s largest diversified manufacturer of professional dental products and technologies, and Rapid Shape, a leading innovator in German-engineered dental 3D printing...

News 24 October 2025

As dental professionals prepare to wrap up 2025, many are setting ambitious goals for the year ahead, yet few have a clear, actionable plan to achieve them.

Orthodontics 08 October 2025

The field of orthodontics in its new era is venturing ahead to more up-to-date technological point of view.

Products 03 October 2025

From Scan to Smile: Aidite’s EZPRINT-P1 and Rapid 3 Deliver a Complete Digital Workflow

Digital dentistry thrives on precision, efficiency, and integration. Aidite has long been a leader in advancing these principles. With the introduction of the EZPRINT-P1 3D Printer, the company now...

Products 30 September 2025

Dentsply Sirona is excited to announce the upcoming launch of an expanded AI-powered CEREC workflow and new milling units¹: CEREC Primemill Lite and CEREC Go, aimed at making Single Visit Dentistry...

Read more

Read more

Much like EMTs rushing to the scene after an accident, stem cells hurry to the site of a skull fracture to start mending the damage. A new finding has uncovered the signaling mechanism that triggers...

Products 05 November 2025

SimplyTest has launched a groundbreaking saliva-based test to detect high-risk strains of oral human papillomavirus (HPV), a major cause of oropharyngeal cancers.

News 05 November 2025

Perimetrics, Inc., a dental technology company pioneering quantitative diagnostics, announced today that the U.S. Food and Drug Administration (FDA) has granted clearance for the InnerView...

News 05 November 2025

On October 15, open enrollment for Medicare began nationwide. Hundreds of thousands of seniors in New Jersey will once again face the challenge of finding the right Medicare coverage, including the...

Digital Dentistry 04 November 2025

Digitalisation is an expanding field in dentistry and implementation of digital teaching methods in dental education is an essential part of modern education.