5 Reasons to Diversify in the Markets

Luigi Campopiano

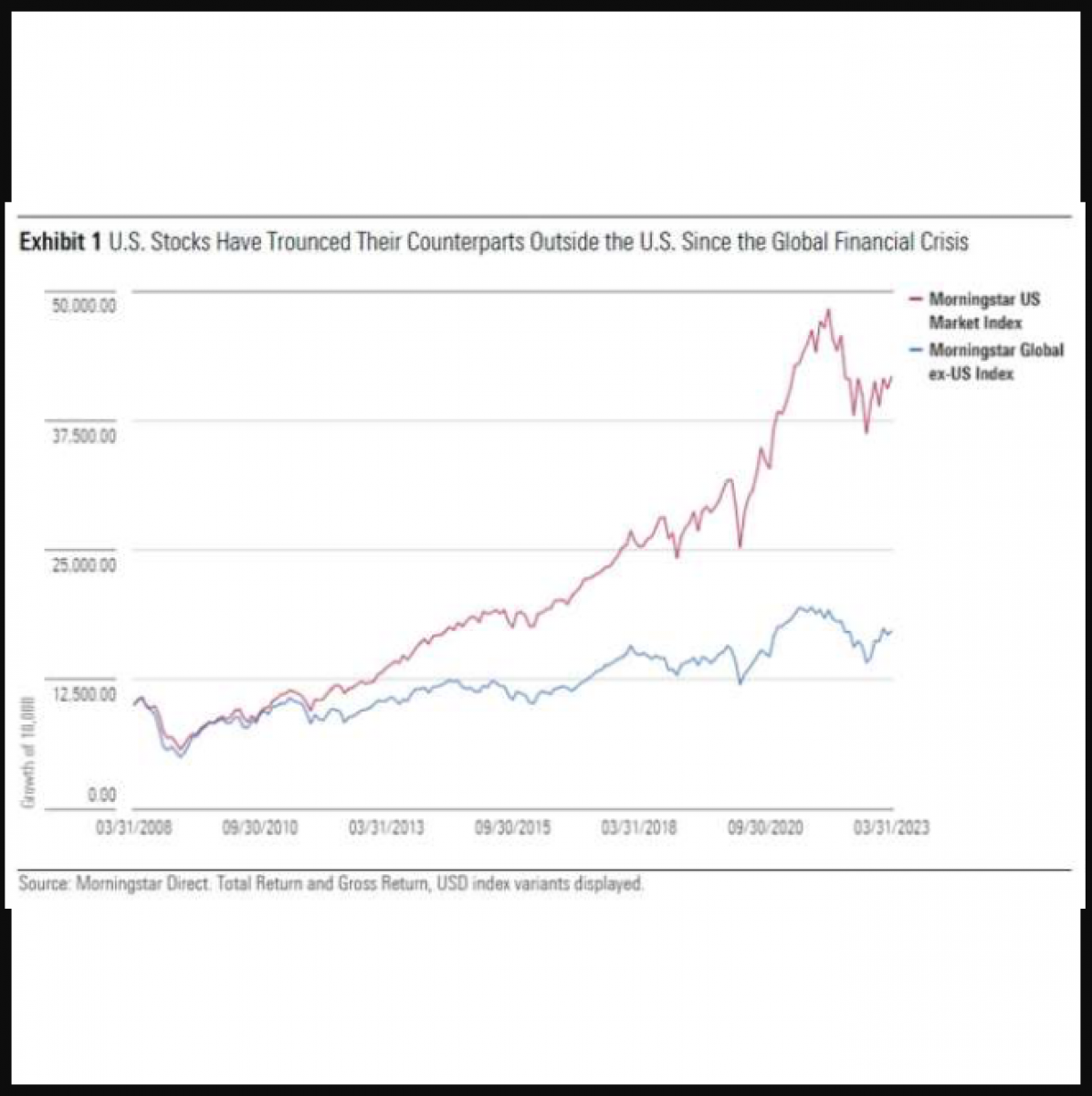

Over the past 15 years, Wall Street has dominated the global scene. The Morningstar US market index (including large, medium, and small companies) has more than quadrupled in value. The global ex-US basket (including developed and emerging markets) hasn't even doubled in value in dollar terms: $10,000 invested in the Morningstar US market at the beginning of the second quarter of 2008 would have grown to $42,000 by the end of the first quarter of 2023, whereas the same amount invested in the global ex-US index would have reached $17,200.

Wall Street dominates the global scene for several reasons:

- The strong rally of companies like Apple, Microsoft, Amazon, Alphabet, Nvidia, and Tesla.

- The inability of stock markets in other parts of the world to keep up.

- The strength of the dollar against major currencies.

These dynamics have led American companies to increase their weight in global indices: Wall Street accounts for nearly 60%, while the weight of the United States in the global economy is about 25%.

An investor should consider investing in the stock markets of other regions for these 5 main reasons:

- Attractive Valuations: International stocks have more attractive valuations compared to American ones. According to Morningstar, "US companies have long been at a premium, but the gap has widened in recent years. In the 2004-07 period, they were at times under a 15% premium, while in the first quarter of 2023 they were 57% more expensive."

- Dividend Yield: International markets offer more attractive dividend returns.

- Less Concentrated Indices: The performance of the US market is heavily dependent on the 10 largest companies by capitalization, which currently have a high price-to-earnings ratio. International stock indices are much more diversified (including 47 developed and emerging countries and about 6,500 securities, with the top ten accounting for 9.3%).

- Markets are Cyclical: Who would have thought that the US would dominate from 2010 to today, after a beginning of the century that was labeled "the lost decade" for American investors due to the bursting of the internet bubble, the recession, and the collapse of the Twin Towers? According to Morningstar researchers, some macro factors could catalyze change:

- The potential recovery of the Chinese economy.

- An increase in fiscal integration in Europe.

- Ongoing corporate restructuring efforts in Japan.

- Demand for raw materials from alternative energy sources.

- Changes in supply chains.

- Growth in emerging markets.

- Automation, artificial intelligence, and pharmaceutical innovation are transversal to regions and sectors.

- Markets Don't Always Move Together in the Same Direction: Global markets are more correlated than before, but diversifying the portfolio across different geographic areas has its advantages (in certain phases, stock exchanges can move in different directions, and sector exposure varies). According to Morningstar, "The US may continue to dominate international stock markets, but the possibility of change should not be underestimated. Diversifying across different geographic areas increases the set of opportunities for an investor."

Related articles

Related articles

News 23 October 2025

The global dental implants market is projected to grow from USD 5.45 billion in 2024 to USD 15.41 billion by 2035, expanding at a CAGR of 9.95% from.

Editorials 10 October 2025

With proud smiles and crisp white coats, ninety-three learners from the DDS Class of 2029 and the International Dentist Pathway Class of 2028 marked the start of their dental careers at the UCSF...

Products 03 October 2025

Dentalhitec Americas recently announced the official U.S. launch of QuickSleeper5, following FDA clearance. Even prior to its American debut, demand from dentists for the QuickSleeper5.

News 26 September 2025

Zuub, the industry’s leading provider of AI-powered dental insurance verification—delivered via SaaS, API, or a hybrid of both—shared key insights from conversations with dental support...

News 23 September 2025

Henry Schein, Inc. (Nasdaq: HSIC), the world’s largest provider of health care products and services to office-based dental and medical practitioners, announced today that its board of directors...

Read more

Read more

Oral pathology 24 October 2025

Isolation and characterization of dental pulp stem cells from a supernumerary tooth

Dental pulp stem cells (DPSCs) were primarily derived from the pulp tissues of primary incisors and permanent third molar teeth, whereas no report to our knowledge has yet been documented on deriving...

Editorials 24 October 2025

From mentoring workshops to leadership insights, the last week’s IU School of Dentistry (IUSD) fall faculty conference and staff retreat brought faculty and staff together respectively for two days...

Products 24 October 2025

At the American Academy of Periodontology’s Annual Meeting, Carestream Dental continues to deliver what’s next in dentistry with the launch of CS 3D.

News 24 October 2025

As dental professionals prepare to wrap up 2025, many are setting ambitious goals for the year ahead, yet few have a clear, actionable plan to achieve them.

News 24 October 2025

The Yankee Dental Congress will take place from January 29, 2026, through January 31, 2026, at the Thomas M. Menino Convention & Exhibition Center in Boston.