5 tips on how to manage loss aversion

Luigi Campopiano

Nobody likes to lose money, but an investor must also know how to lose because the markets follow the flows. Sometimes the flows swing upwards and sometimes downwards: When things go well, it's easy for everyone, but when they go south, you must keep a cool head.

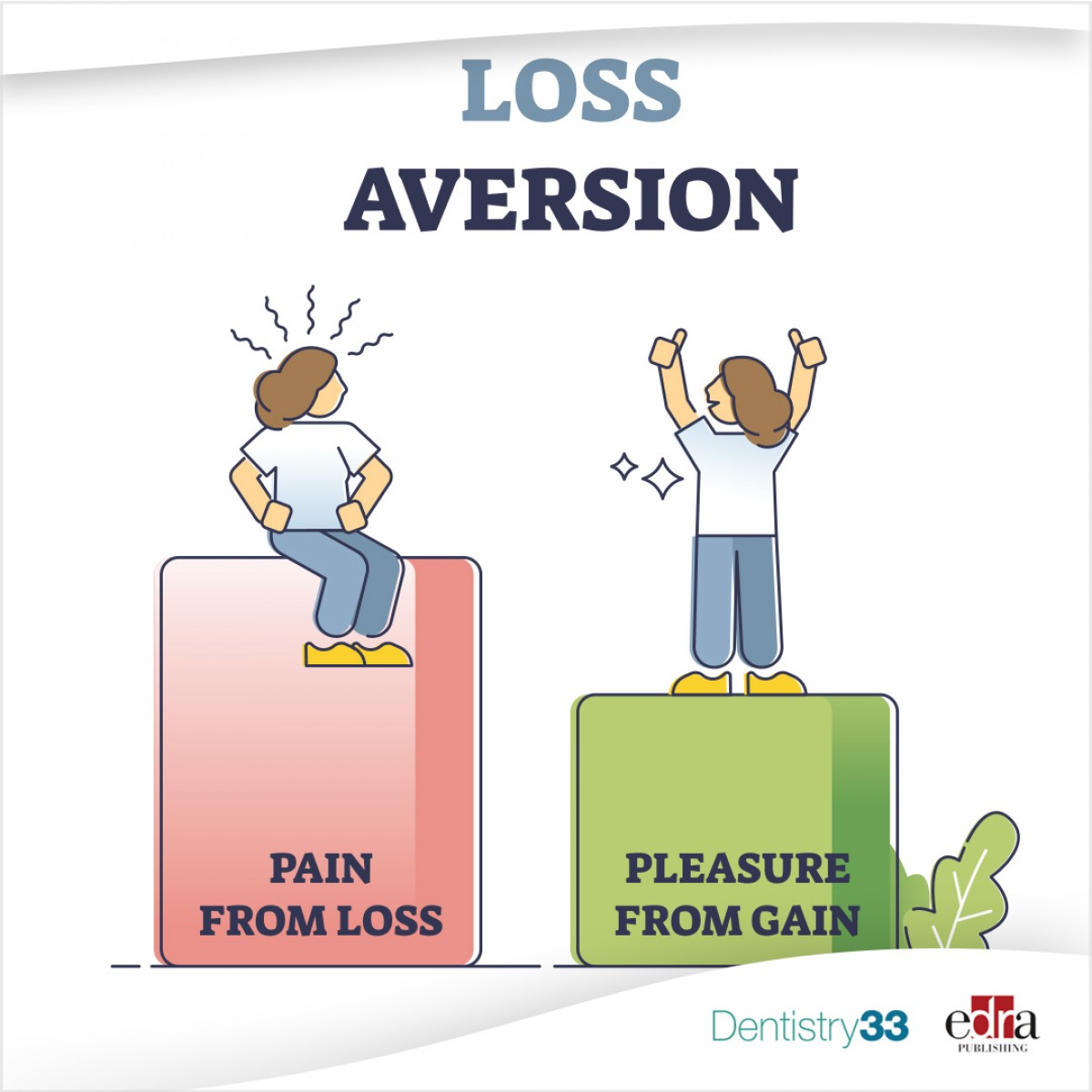

Faced with a loss, psychological mechanisms take over. Research has found that a person, by nature, attributes greater weight to a loss than that which they attribute to gains. In behavioral finance, it is called "loss aversion.”

Loss aversion affects not only the financial sphere but every context in which gains and losses occur. This is a fundamental discovery of the Prospect theory developed in 1979 by Daniel Kahneman and Amos Tversky, psychologists and economists. They found that losing hurts 2.5 times more than the pleasure of earning the same amount.

Why is this the case? The main reason is that individuals do not objectively evaluate the loss and gain but assess them according to expectations. If you invest money, the expectation is to earn.

No one is immune to loss aversion. Even the most experienced investors suffer during bear markets. Still, there are certain strategies to help manage the emotional impact that losses can have on your morale when dealing with investments. The strategies include to:

- Make an investment that is appropriate to your profile and risk appetite. Knowing yourself and what you want to get out of your investments is important. If we are unwilling to see negative fluctuations in your assets, the instruments to choose are stable and prudent ones, with little gain and few losses.

- Gradually enter the market. Investing a sum with periodic monthly payments is a wise approach. The emotionality of going "all-in" is reduced. It is easier to see a loss on smaller payments when the markets are negative, especially if, in the previous months, the total capital of the investment has moved in a positive direction.

- Contextualize the loss within a long timeframe. Go into an investment looking five to 10 years ahead. Loss aversion is an instinctive short-sighted reaction that neglects long-term prospects. Since it is precisely in the long term that the financial game is played, moments of loss are also useful to win it.

- Take advantage of the loss. The best time to invest is when the market drops, and when many people liquidate investments. It takes a bit of a cool head, and you can overcome fear by becoming more aware that markets are cyclical.

- Avoid checking the value of investments daily. Plan moments to check your calendar: every six months is enough for those who decide on a medium or long-term investment. Reviewing investments once a year is even better. If the initial strategy is on track, there will be no surprises. Otherwise, you must ask yourself questions about the strategy and ask for advice from a trusted expert.

Related articles

Related articles

News 30 October 2025

GTCR, a leading private equity firm, announced the simultaneous signing and closing of a strategic, structured minority investment in Solmetex (the “company”).

vVARDIS, a Swiss high-growth dental company, and OrbiMed, a leading healthcare investment firm, recently announced the closing of a $35 million financing.

Smile Partners USA (“Smile Partners” or the “company”), a portfolio company of Silver Oak Services Partners LLC (“Silver Oak”), announced today a strategic investment from a new...

Market 29 November 2024

In financial markets, the butterfly effect is not uncommon—a phenomenon where small changes in conditions can lead to significant long-term variations in a system's behavior.

Their gift is the latest for the Power of 1,000 Campaign, which aims to raise $1 million for the mobile clinic to allow for treatment to even more underserved communities across Southern California.

Read more

Read more

Periodontology 14 November 2025

This study was carried out to assess the oral hygiene awareness and practices amongst patients visiting the Department of Periodontology at Gian Sagar Dental College and Hospital, Ramnagar (Patiala).

Editorials 14 November 2025

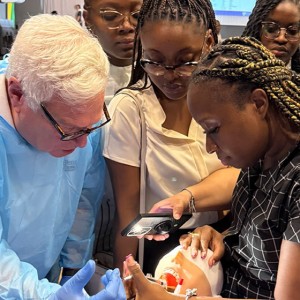

Penn Dental Medicine shared its expertise in caring for persons with disabilities with dental care providers from throughout Jamaica at a 1 ½ -day hands-on continuing education program, held October...

News 14 November 2025

Dr. Thomas M. Paumier, a dentist in Canton, Ohio, is the new President-Elect of the American Dental Association (ADA). Dr. Paumier was elected at the ADA House of Delegates meeting in Washington,...

News 14 November 2025

Premier Dental Implants & Prosthodontics is proud to announce the opening of its newly renovated dental office and the launch of its new website

News 14 November 2025

Henry Schein One and AWS Collaborate to Transform Global Dentistry with Generative AI

Industry leaders join forces to bring advanced AI capabilities to dental technology platforms — redefining patient care, clinical efficiency, and practice performance worldwide