The great occasion of the silver economy

Luigi Campopiano

Living up to 90 or 100 years is a success for humanity, an achievement that brings with it risks and benefits.

With longevity changes many of us arrive at old age still in good physical shape. We remain socially active and passionate about life. However, the last decades of life also change due to our fragility and the need for daily assistance that is more sporadic today.

For our grandparents, having a basic education was sufficient for life. But today what you learn in school has changed and evolved with the use of technology. In addition to education, you need to stay updated on technologies, develop other curiosities and skills, and maintain flexibility throughout your professional life.

If you have saved over the years while working — to supplement your retirement income and allow the same standard of living for 15 to 20 years from retirement age — you may find that your savings must last longer than expected. Longevity is a gift if you plan for it, to get the best out of it.

Financial advisors transform themselves into longevity navigators, helping their clients visualize life to come, with related risks and opportunities, while leaving the most functional roles to technology.

Planning for longevity means:

- Limiting the financial risk of surviving your savings, bearing in mind an average life expectancy of 76 years in the U.S. Once you pass a certain age, like 80, the chances of reaching the age of 90 increase.

- Your advisor should support you, the client, and discuss the prospects of old age and related needs. This support could include tidying up movable and immovable property, optimizing the possible annuities to cover the residual life expectancy and the inheritance will. Your advisor should help you evaluate real estate and determine whether it will be adequate as you age. Is it worth considering the sale of the house for a more suitable residence for today and for tomorrow?

- Exploring a long-term care insurance policy. You can count on an income supplement that covers the expense of a caregiver or part of the rent in a protected apartment. This is also viewed as asset protection.

CNBC reporter Annie Nova recently spoke with some of the top financial advisors in the U.S. These experts said that inflation is top of mind for clients and that the COVID-19 pandemic changed the concept of longevity for many. Retirees are rethinking their desire to spend and enjoy life, Mark Mirsberger, CEO of Dana Investment Advisors in Wisconsin, told CNBC.

Related articles

Related articles

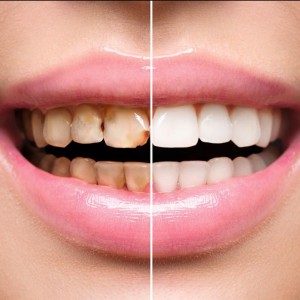

Restorative dentistry 28 February 2024

Longevity in Dental Restorations: Beyond the Role of Composite Materials

While it is commonly believed that the choice of restorative material significantly influences the longevity of direct restorations in cavities caused by caries, a systematic review by Demarco et al....

Prosthodontics 13 December 2023

Do direct and indirect reconstructions have the same clinical longevity?

Resin composite materials are commonly used to perform direct restorations. Improvements in their mechanical and esthetic properties have characterized the last decade. Nevertheless, resin composite...

Editorials 04 October 2023

Longevity of dental materials – what is it really about and what can we do about it?

Resin composite materials are the material of choice for restoring posterior and anterior cavities due to their proven good mechanical and esthetical characteristics.

Pediatric dentistry 26 October 2022

One of the milestones of preventing occlusal caries is the early application of sealants for pits and fissures. Recently, a new group of primed adhesive sealants have been introduced with an aim...

Market 22 July 2022

Author: Luigi Campopiano

There is no single type of old age, because the period that projects adulthood towards an increase in longevity extends to a broad spectrum of years, between 55 and 85-90, in which there are...

Read more

Read more

Implantology 03 February 2026

Bone Structure, Metabolism, and Physiology Its Impact on Dental Implantology

When placing implants in the mandible or maxilla, it is important for clinicians to understand the process of bone remodeling, the different types of bone, and how these factors can affect the...

Editorials 03 February 2026

Dr. Alireza Sadr of the Department of Restorative Dentistry has been appointed as the first-ever UW School of Dentistry Director of Digital Dentistry and Innovation, effective Jan. 1, 2026.

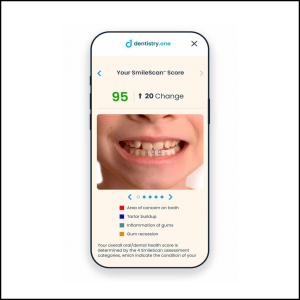

Products 03 February 2026

Families can now use SmileScan™, a free, AI-powered oral health scan offered by Dentistry.One, to identify potential areas of concern and receive an overall oral health score.

Investment supports professional growth for future oral health leaders and expands community outreach for underserved Oklahomans

News 03 February 2026

Henry Schein, Inc. (Nasdaq: HSIC), the world’s largest provider of health care solutions to office-based dental and medical practitioners, announced recently that it will release its fourth quarter...