Pension: Elderly Individuals Do Not Decumulate Their Savings

Luigi Campopiano

In theory, estate planning should work as follows (based on the life-cycle theory developed by the Italian Nobel laureate in economics, Franco Modigliani): individuals save money when their incomes are high, with the intention of using these savings when their incomes decrease. If everything goes as planned, this approach helps smooth abrupt changes in one's lifestyle that could occur when, upon reaching retirement, their incomes reduce. The reality, at least in Europe, doesn't necessarily follow this model; even in old age, many individuals do not spend the savings they have accumulated (in over 50% of cases, people continue to accumulate money).

According to the results published in a paper titled "Do Retired Europeans Decumulate Their Wealth? The Importance of Bequest Motives, Precautionary Saving, Public Pensions, and Homeownership," authored by two professors, Luigi Ventura (Professor of Economics at Sapienza University of Rome) and Chales Yuji Horioka (Professor at Kobe University), on average, Europeans do not decumulate but rather increase their savings by 6.6% over a three-year period, with less than half of them choosing to spend some of their savings. Why do elderly Europeans continue to save? Some of the answers are particularly interesting:

- Limited impact of the longevity risk: The risk that an exceptionally long life could deplete savings, leaving them insufficient to fund the desired lifestyle or, worse, medical and long-term care expenses. However, according to data extracted from the "Survey of Health, Ageing and Retirement in Europe," the precautionary savings behavior is not significantly driven by this risk. The authors found only limited evidence that precautionary saving is due to the risk of longevity and uncertainty about future medical and long-term care expenses. The authors pointed out that when elderly individuals in Japan or the United States do not decumulate their savings, the influence of longevity risk and precautionary saving is more relevant, probably because social safety nets in Europe are better developed than in Japan or the USA.

- Pension and homeownership matter: If elderly Europeans save even in old age, it's primarily for other reasons. This behavior is influenced by generous public pension systems and potential homeownership. The two economists argue that this explains why retired homeowners in Europe are reluctant to sell their homes or use them as collateral for loans.

- The desire to pass on wealth to heirs: This is the most important factor behind the accumulation of savings by elderly Europeans. The economists discovered that the wealth accumulation rate of retirees would be negative (i.e., they would decumulate) if they were not saving to leave an inheritance to their heirs.

In conclusion, the authors believe that the prevalence of elderly individuals who are reluctant to decumulate their savings will not lead to an overall increase in the propensity to consume as the population continues to age. To reverse this trend, given that the desire to leave an inheritance to heirs is the predominant motivation for saving, consumption among the elderly could be stimulated by increasing inheritance taxes, thereby reducing the incentive to accumulate assets for the purpose of leaving an inheritance.

Related articles

Related articles

Editorials 02 December 2025

Thomas Miller joined Harvard School of Dental Medicine (HSDM) as Dean for Administration and Chief Operations Officer a year ago and has been a key figure through a period of transformation at the...

Market 29 November 2024

In financial markets, the butterfly effect is not uncommon—a phenomenon where small changes in conditions can lead to significant long-term variations in a system's behavior.

Market 22 November 2024

The creator economy, also known as the passion economy, is built around creators and influencers.

News 15 November 2024

The main goal for many investors is not to lose money, but they often overlook the time period over which they hope to achieve this.

News 05 November 2024

The food sector could offer attractive opportunities for investors in the coming years

Read more

Read more

Implantology 03 February 2026

Bone Structure, Metabolism, and Physiology Its Impact on Dental Implantology

When placing implants in the mandible or maxilla, it is important for clinicians to understand the process of bone remodeling, the different types of bone, and how these factors can affect the...

Editorials 03 February 2026

Dr. Alireza Sadr of the Department of Restorative Dentistry has been appointed as the first-ever UW School of Dentistry Director of Digital Dentistry and Innovation, effective Jan. 1, 2026.

Products 03 February 2026

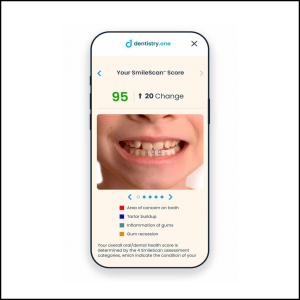

Families can now use SmileScan™, a free, AI-powered oral health scan offered by Dentistry.One, to identify potential areas of concern and receive an overall oral health score.

Investment supports professional growth for future oral health leaders and expands community outreach for underserved Oklahomans

News 03 February 2026

Henry Schein, Inc. (Nasdaq: HSIC), the world’s largest provider of health care solutions to office-based dental and medical practitioners, announced recently that it will release its fourth quarter...