Savings between prudence and planning

Author: Luigi Campopiano

Is savings what we have left in our pockets after we spend? Absolutely not. Savings are not a residual variable. It is necessary to combine the prudential vision with the planning one. Italian families, as regards the provision, have excellent foundations, but the traditional prudence risks being too conservative: this is where financial advice must come into play to raise the prospects of families from the short to the long term. Italians are very willing to activate their savings to contribute to the reconstruction of Italy (think of the great success of emissions such as the BTP Futura). From the Assoreti and Eumetra research, recovery of trust in the bank institution and an awareness of the need for savings planning and financial education emerge.

The construction of a project affects all families (not only the wealthiest ones) and the financial consultant becomes fundamental because he must support them in the path of development and progress (there are often opportunities that families do not know about). It is not just about investing, but also about getting help in certain moments of vulnerability: you have to go from talking about a portfolio to talking to people.

Today the quality of the consultancy has increased (in the 1980s the consultant only recommended a good financial product to the client, today he supports the planning of savings) and we are moving from the business of finance to that of trust because we no longer start from consumption and savings, but from people's projects.

Obviously, there is a need to increase the focus on young people, as the young consultant has to learn balance, which does not always match with the young age (the topic of financial education is also strongly felt at the government level).

The amount of Italian savings can make a difference only when we realize our power as investors: there is a difference between beneficial and harmful investment, as the former positively influence sustainability, progress, the environment, while the latter does not. . The investor can change the world by investing in the right sectors. It is a pity that the financial part of Italian wealth is too cautious, especially because there is an excess of unproductive (often negative) real estate assets due to taxes, management costs, lack of yield, the impossibility of selling. Financial advisors will have to wake up savings and create good GDP. The financial advisor, managing the assets, is responsible for

Read more

Read more

Periodontology 14 November 2025

This study was carried out to assess the oral hygiene awareness and practices amongst patients visiting the Department of Periodontology at Gian Sagar Dental College and Hospital, Ramnagar (Patiala).

Editorials 14 November 2025

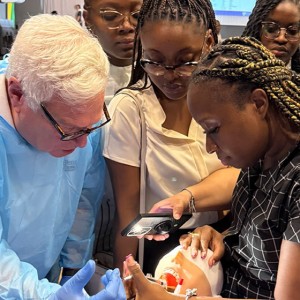

Penn Dental Medicine shared its expertise in caring for persons with disabilities with dental care providers from throughout Jamaica at a 1 ½ -day hands-on continuing education program, held October...

News 14 November 2025

Dr. Thomas M. Paumier, a dentist in Canton, Ohio, is the new President-Elect of the American Dental Association (ADA). Dr. Paumier was elected at the ADA House of Delegates meeting in Washington,...

News 14 November 2025

Premier Dental Implants & Prosthodontics is proud to announce the opening of its newly renovated dental office and the launch of its new website

News 14 November 2025

Henry Schein One and AWS Collaborate to Transform Global Dentistry with Generative AI

Industry leaders join forces to bring advanced AI capabilities to dental technology platforms — redefining patient care, clinical efficiency, and practice performance worldwide