The speculative bubbles

Author: Luigi Campopiano

Pictet Asset Management defines the speculative bubble as a considerable (and often unjustified) increase in the prices of an asset deemed innovative or profitable, which causes a surge in demand in a short period. But how many are there in the history of investments?

Among the best known speculative bubbles (and among the first in modern history) are:

• The tulip bubble in seventeenth-century Holland. Following the introduction of the tulip in the Netherlands and its consequent recognition as a flower symbol of high social status, the price of tulips increased exponentially due to speculation on the bulbs that have just been planted or about to be planted. Prices continued to rise, filling the pockets of tulip traders and selling for 6,000 florins (the average annual income was about 150 florins). But in 1637, suddenly, prices reached their peak and, no longer meeting demand, traders began to sell, causing the bubble to burst;

• The railway boom in 1840 in England and the United States;

• The boom of cars and radios in 1920;

• The boom of electronic transistors in 1950;

• The boom of home computers and biotechnology in 1980;

• The Dotcom bubble at the turn of the 2000s.

That of speculative bubbles is, therefore, a recurring phenomenon in the history of investments. Many today wonder if the US tech sector is not the next to show a sequence of events similar to a speculative bubble destined, sooner or later, to explode. However, in order not to fall back into the same mistakes, savers can learn from the past, remembering that the main ingredient for each bubble is the attitude of individuals to implement imitative behaviors that follow the actions of other investors or public opinion: knowing the psychological dynamics behind investment decisions

Related articles

Related articles

Market 30 January 2022

Author: Luigi Campopiano

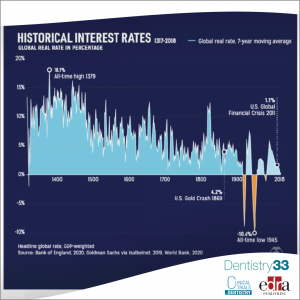

The Bank of England reconstructs global real interest rates (on an annual basis) from the fourteenth to the present and the data shows rates always falling. ...

Market 06 January 2022

Author: Luigi Campopiano

According to behavioral finance experts at Oxford Risk, the current environment has created a situation in which the risk of emotional investments has reached a...

Market 09 December 2021

Author: Luigi Campopiano

Here are some figures behind the change:• Life expectancy in the world has risen by 24% in the last thirty years (from 58 years in 1970 to 72 in 2020);• Online commerce up 55% over the next three...

Read more

Read more

Oral pathology 24 October 2025

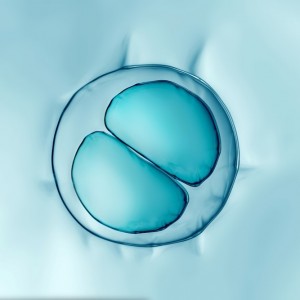

Isolation and characterization of dental pulp stem cells from a supernumerary tooth

Dental pulp stem cells (DPSCs) were primarily derived from the pulp tissues of primary incisors and permanent third molar teeth, whereas no report to our knowledge has yet been documented on deriving...

Editorials 24 October 2025

From mentoring workshops to leadership insights, the last week’s IU School of Dentistry (IUSD) fall faculty conference and staff retreat brought faculty and staff together respectively for two days...

Products 24 October 2025

At the American Academy of Periodontology’s Annual Meeting, Carestream Dental continues to deliver what’s next in dentistry with the launch of CS 3D.

News 24 October 2025

As dental professionals prepare to wrap up 2025, many are setting ambitious goals for the year ahead, yet few have a clear, actionable plan to achieve them.

News 24 October 2025

The Yankee Dental Congress will take place from January 29, 2026, through January 31, 2026, at the Thomas M. Menino Convention & Exhibition Center in Boston.