Silver wealth and falling markets

Market corrections and bear markets worry all classes of investors. Still, retirees are particularly penalized if their portfolios lose value, especially when they are about to enter the decumulation phase. In the face of this harsh reality, being told to remain patient is probably not much comfort. What to do, then? While there are no easy answers, you can look to recent history to learn some lessons. Adopting proactive household cash management has proven beneficial in the past. Similarly, significant changes in asset allocation have historically resulted in investors underperforming relative to the broader market.

Here are 4 tips that have helped many retirees cope with and overcome past downturns:

1. Cut expenses. It is good to reduce your spending habits and thus avoid decreasing your savings. A possible approach is to divide the budget into needs, wants, and desires and then consider downsizing the two categories. Giving up superfluous expenses will allow you to have more time margin and allow investments to recover;

2. Streamline income and expenses. When withdrawing from several accounts, knowing exactly how much you spend each year can be difficult. To keep track of daily expenses, it is better to have a single account to converge all the different cash flows. This will make it possible to periodically check the account to make sure that the total amounts of expenses are in line with the financial plan;

3. Create a two-year cash buffer. For retirees, the income cycle involves the sale of assets (sale of shares, real estate, etc.) and cash withdrawals. This is suboptimal for senior profiles: in declining markets, liquidating a greater number of assets is necessary to create the same income because one is forced to sell downwards. Instead, it is necessary to establish the level of liquidity necessary for the following 24 months and consider the provision of this amount in a solution with very few fluctuations (e.g., money market);

4. Don't distort your asset allocation. Although selling may seem like a wise choice in times of difficulty on the equity and bond markets, completely exiting these asset classes to switch to liquidity could be wrong for at least three reasons. First, market timing is a futile effort (you need to know when to sell stocks and when to re-enter the market. If momentum is lost, yields can drop dramatically over time). Second, rising rates won't automatically imply that bonds are a bad investment. Finally, increasing liquidity is not cost-free and makes assets particularly vulnerable during high inflation.

Related articles

Related articles

News 23 October 2025

The global dental implants market is projected to grow from USD 5.45 billion in 2024 to USD 15.41 billion by 2035, expanding at a CAGR of 9.95% from.

News 19 September 2025

Specialist business property adviser, Christie & Co, has launched its Dental Market Review 2025 report, which offers a panoramic view of the UK dental business sector, spotlighting important...

News 10 September 2025

Imagen Dental Partners, a collaborative dental partnership organization, is pleased to announce its entry into Kentucky through a new partnership with Toothologie, led.

News 02 September 2025

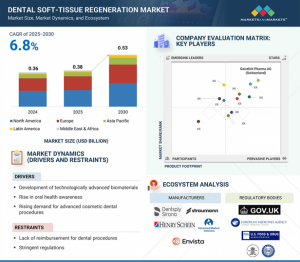

The “Dental Soft Tissue Regeneration Market (2025 Edition): Analysis By Product Type, By Application, By End-User: Market Insights and Forecast (2021-2031)” report has been added to...

News 15 August 2025

Chord Specialty Dental Partners (“Chord”), a premier dental support organization, today announced its partnership with Dr. J Pediatric Dentistry, a leading pediatric dental group serving families...

Read more

Read more

Digital Dentistry 19 November 2025

Increasing awareness of tooth fracture, both complete and incomplete, as a significant disease entity has led to improved diagnostic techniques.

Editorials 19 November 2025

As Ellen Simmons-Shamrell of the Class of 1977 wrote her annual check for the Michael D. Scotti, DMD Endowed Scholarship—established in memory of her late classmate—she reflected on how different...

Products 19 November 2025

Smartee Denti-Technology has unveiled the Smartee Digital Orthodontic Technology Exhibition Hall, a 1,200-square-meter space dedicated to showcasing the company’s innovations in clear aligner...

News 19 November 2025

Coupa, the global leader in AI-powered spend management, today announced a new collaboration with Specialized Dental Partners, a premier dental support organization (DSO) dedicated to enabling its...

News 19 November 2025

Breakthrough T1D has been selected as a 2025 Health Access Hero Award grant recipient by Sun Life U.S. and DentaQuest.