The invisible crash that was Black Monday

Luigi Campopiano

In the realm of the stock market and equity investments, those who buy time are the winners. History narrates this tale. On the infamous Black Monday — Oct. 19, 1987 — the greatest single day drop in the history of the American stock market occurred.

The Dow Jones lost 22.6% within a single trading day. This is the largest percentage decline ever recorded; neither before nor after has there been a more significant drop.

Even today, the causes of the crash remain under debate. The most widely endorsed explanation attributes the responsibility to computer programs that would automatically trigger selling orders to prevent even worse losses. Another theory, however, suggests that once again, human factors drove the race towards an exit among all market participants.

The atmosphere was along the lines of "the end of the world." The stock market was coming off a five-year golden period following the end of the 1981-82 recession caused by a sharp rise in interest rates. From August 1982 to August 1987, the Dow Jones surged from 776 to 2,722 points, and most of the world's markets experienced similar gains.

This is why, despite there being signs of the market's "fatigue," traders were taken aback by the abruptness of the decline. At the end of the preceding week, substantial sell orders occurred, and the market had closed significantly lower on Friday. Traders believed that they could manage the sales.

However, when the market opened on Monday, the pronounced imbalance between selling and buying orders led to a rapid plunge in prices.

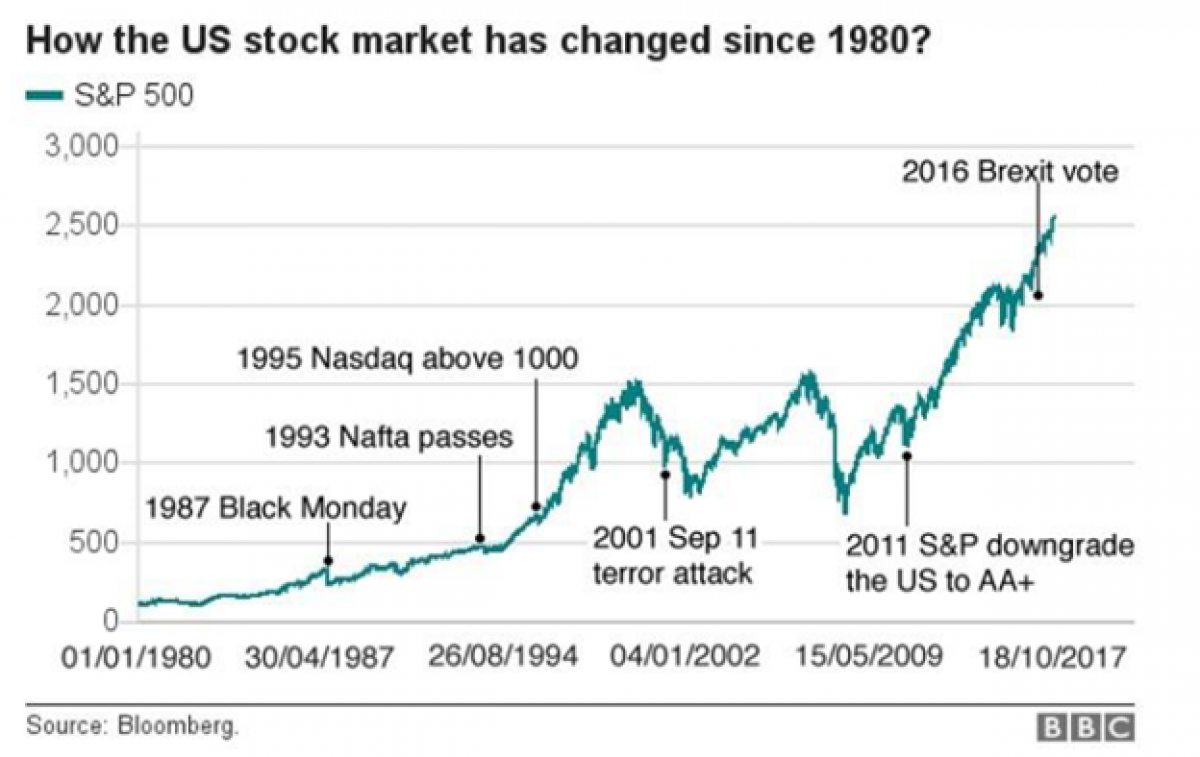

The emotional impact on investor psychology was devastating, and rumors circulated among traders about the end of the stock market. Even today, looking at the chart, it remains unsettling, 35 years later.

However, from a different perspective, we realize that time heals all wounds.

This chart depicts the performance of the S&P 500 from 1980 to 2017. What about the 1987 crash? Can you spot it in the chart below? How does it appear?

What once appeared as an endless vertical crash, when viewed on a broader time scale, returns to its true nature: a significant market setback but not the end of the world.

The complex year of 2022, driven by a combination of inflation and rising interest rates, is once again challenging investor certainties. Even today, a change in perspective is needed to put events back into their proper dimensions. A drop of 20-25% is significant but it can happen.

Certainly, we thought this was possible for stocks, less so for bonds, but sometimes it occurs. Those who have the patience to wait will see prices rebound, a mechanical occurrence in bonds, while those who sell will squander their money.

Related articles

Related articles

News 30 October 2025

GTCR, a leading private equity firm, announced the simultaneous signing and closing of a strategic, structured minority investment in Solmetex (the “company”).

vVARDIS, a Swiss high-growth dental company, and OrbiMed, a leading healthcare investment firm, recently announced the closing of a $35 million financing.

Smile Partners USA (“Smile Partners” or the “company”), a portfolio company of Silver Oak Services Partners LLC (“Silver Oak”), announced today a strategic investment from a new...

Market 29 November 2024

In financial markets, the butterfly effect is not uncommon—a phenomenon where small changes in conditions can lead to significant long-term variations in a system's behavior.

Their gift is the latest for the Power of 1,000 Campaign, which aims to raise $1 million for the mobile clinic to allow for treatment to even more underserved communities across Southern California.

Read more

Read more

Digital Dentistry 19 November 2025

Increasing awareness of tooth fracture, both complete and incomplete, as a significant disease entity has led to improved diagnostic techniques.

Editorials 19 November 2025

As Ellen Simmons-Shamrell of the Class of 1977 wrote her annual check for the Michael D. Scotti, DMD Endowed Scholarship—established in memory of her late classmate—she reflected on how different...

Products 19 November 2025

Smartee Denti-Technology has unveiled the Smartee Digital Orthodontic Technology Exhibition Hall, a 1,200-square-meter space dedicated to showcasing the company’s innovations in clear aligner...

News 19 November 2025

Coupa, the global leader in AI-powered spend management, today announced a new collaboration with Specialized Dental Partners, a premier dental support organization (DSO) dedicated to enabling its...

News 19 November 2025

Breakthrough T1D has been selected as a 2025 Health Access Hero Award grant recipient by Sun Life U.S. and DentaQuest.