Strategies to better face the Bear (Market)

Luigi Campopiano

Fears over the war in Ukraine, high inflation, and a possible recession are weighing heavily on market sentiment as investors pull the oars in the boat considering the prospect of increasingly aggressive central banks that raise their rates.

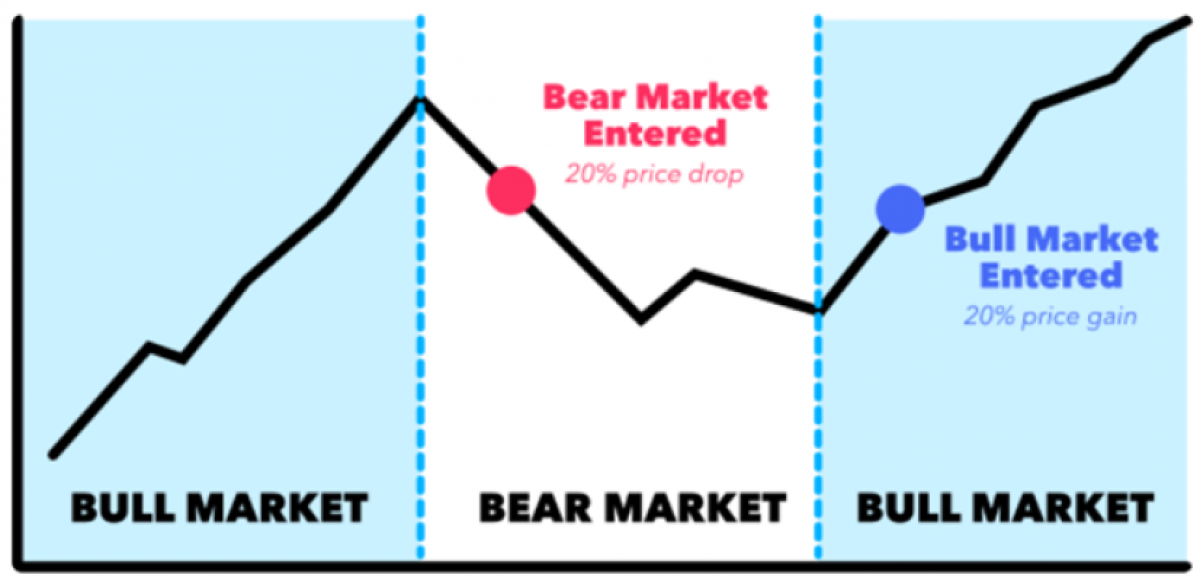

Many asset classes are in negative territory, and some are even in what’s known as a bear market. What exactly is a bear market?

There is no official designation on Wall Street, but a bear market typically begins when an index falls 20% below its previous high and ends when it rebounds 20% from its low. A bear market phase consists of a prolonged downward trend in stock market prices. It usually lasts from a few months to a few years. The duration prevents this phase from being confused with downward movements that are more limited in time.

Another definition of the bear market is when investors are more risk-averse than risk-seeking and prefer less speculative instruments such as bonds. The 20% threshold results from an empirical estimate and is not a certainty. At a fundamental level, there is no valid explanation to identify this level, but it has remained so over the decades.

A recession is not the same thing as a bear market. To have a recession, the prerequisite is a contraction of the economy for two consecutive quarters of the year. An economy can go into recession without its stock market in a bear market, but a recession often occurs following a bear market.

The four phases of a bear market are:

- High prices and high investor sentiment. Towards the end of this season, investors begin to exit the markets to cash in on profits.

- Stock prices begin to fall sharply, trading activity and corporate profits begin to decline, and previously positive economic indicators begin to dip below average. Already at this stage, some investors start to panic and start closing their positions.

- Speculators begin to enter the market, consequently increasing volatility and trading volumes.

- Stock prices continue to fall, but more mildly. In this phase, low prices and good news attract investors again, and thus bear markets start to veer into bull markets.

In bear markets, it becomes more difficult to find suitable entry points, as it is nearly impossible to determine the bottom of a bear market.

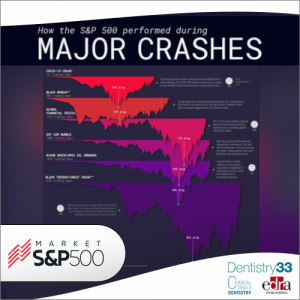

History shows that when the S&P 500 enters a bear market, it tends to stay there for a while. Since 1929, the index has entered the bear market 17 times. According to statistics, on average, bear markets cause a decline of about 38%, although since 1946, the average loss has been less than 33%.

Bear markets have also become less frequent over the decades. In fact, there have only been five since 1990.

The table below shows the latest bear markets of the S&P 500, with the relative collapses and duration.

History is important, but let's remember that stock market movements are never repeated under the same conditions. The current phase comes in a period in which the U.S. and other countries are facing great inflationary pressures, aggravated by an increase in energy prices due to the Ukraine-Russia war. The surge in inflation is also driving central banks worldwide into aggressive monetary tightening, which could derail the global recovery and lead to recessions in several countries.

To face this market phase, knowing exactly what to do when the markets drop is essential to not be overwhelmed by a wave of generalized pessimism. To manage a collapse, it is necessary to have a clear and defined investment strategy and know how to control the stressful emotions that such a situation generates. In these situations, it is essential to remember that it is impossible to obtain a return if you do not accept the possibility of exposing yourself to collapse or some potential losses.

In general, in situations of high uncertainty in the markets, financial education and the support of an expert can make the difference, helping to manage emotions and not lose sight of the sense of the investment that has been made, the horizon timing and goals.

The farsighted investor who remained invested during the bear market of March 2020 obtained higher returns than the speculator, who tried to beat the market. The scared investor in this scenario divested completely (source: Moneyfarm survey of 33,500 customers).

It is no surprise that the decision to exit the market, during or immediately after the pandemic outbreak, turned out to be the worst because it did not allow the recovery of the following months to benefit, a recovery whose extent was decidedly difficult to predict.

Graphics: LPL Research

Related articles

Related articles

Editorials 24 March 2023

Peter Lynch is one of America's top investors with a background in mutual fund management. He is famous for his frank language and his strong opinions, such as the one about the uselessness of...

Market 02 December 2021

Author: Luigi Campopiano

Market peaks and dips have been (and will be) a persistent feature of the S & P500 (and equity markets in general) over time. However, the forces behind each rise and fall are often less clear....

News 30 October 2025

GTCR, a leading private equity firm, announced the simultaneous signing and closing of a strategic, structured minority investment in Solmetex (the “company”).

vVARDIS, a Swiss high-growth dental company, and OrbiMed, a leading healthcare investment firm, recently announced the closing of a $35 million financing.

Smile Partners USA (“Smile Partners” or the “company”), a portfolio company of Silver Oak Services Partners LLC (“Silver Oak”), announced today a strategic investment from a new...

Read more

Read more

Digital Dentistry 19 November 2025

Increasing awareness of tooth fracture, both complete and incomplete, as a significant disease entity has led to improved diagnostic techniques.

Editorials 19 November 2025

As Ellen Simmons-Shamrell of the Class of 1977 wrote her annual check for the Michael D. Scotti, DMD Endowed Scholarship—established in memory of her late classmate—she reflected on how different...

Products 19 November 2025

Smartee Denti-Technology has unveiled the Smartee Digital Orthodontic Technology Exhibition Hall, a 1,200-square-meter space dedicated to showcasing the company’s innovations in clear aligner...

News 19 November 2025

Coupa, the global leader in AI-powered spend management, today announced a new collaboration with Specialized Dental Partners, a premier dental support organization (DSO) dedicated to enabling its...

News 19 November 2025

Breakthrough T1D has been selected as a 2025 Health Access Hero Award grant recipient by Sun Life U.S. and DentaQuest.

.png)