Bear market: because they always 'deceive' investors

Luigi Campopiano

In the past year, we have witnessed a sharp decline in all the main stock exchanges, especially the ones in America with very strong weekly or daily rebounds. This is completely normal in bear-ish phases.

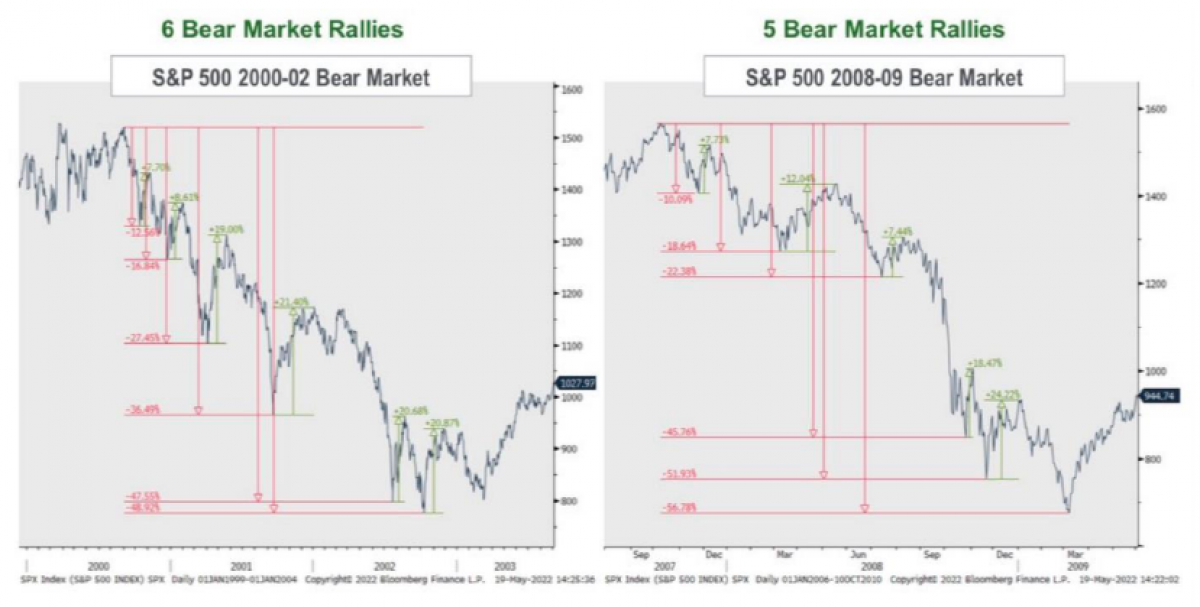

The figures below show the trends of the main recent bear markets in 2000 and 2008, with total declines of 49% and 57%, respectively. Yet while this ultimately ended up being the definitive drop, we saw several rebounds, sometimes even more than 20%, with prices eventually continuing to fall.

Image: Callum Thomas

History is always different, and the trend of the graphs never exactly replicate a past event. We could even retest the new highs and witness a new recovery of the 10-year bull market. However, it is necessary to emphasize the prudence of this period and to not get caught up in the euphoria of rebounds, which are normal and risk deceiving investors.

For the investor who thinks in the medium-long term, the only way to approach these markets consists in the basics of the investment:

- Diversification (by asset class)

- Periodic rebalancing

- Fractional entries and PAC (entry thresholds can be established, for example on drops of 10 to 15% from time to time, with the liquidity still in the portfolio).

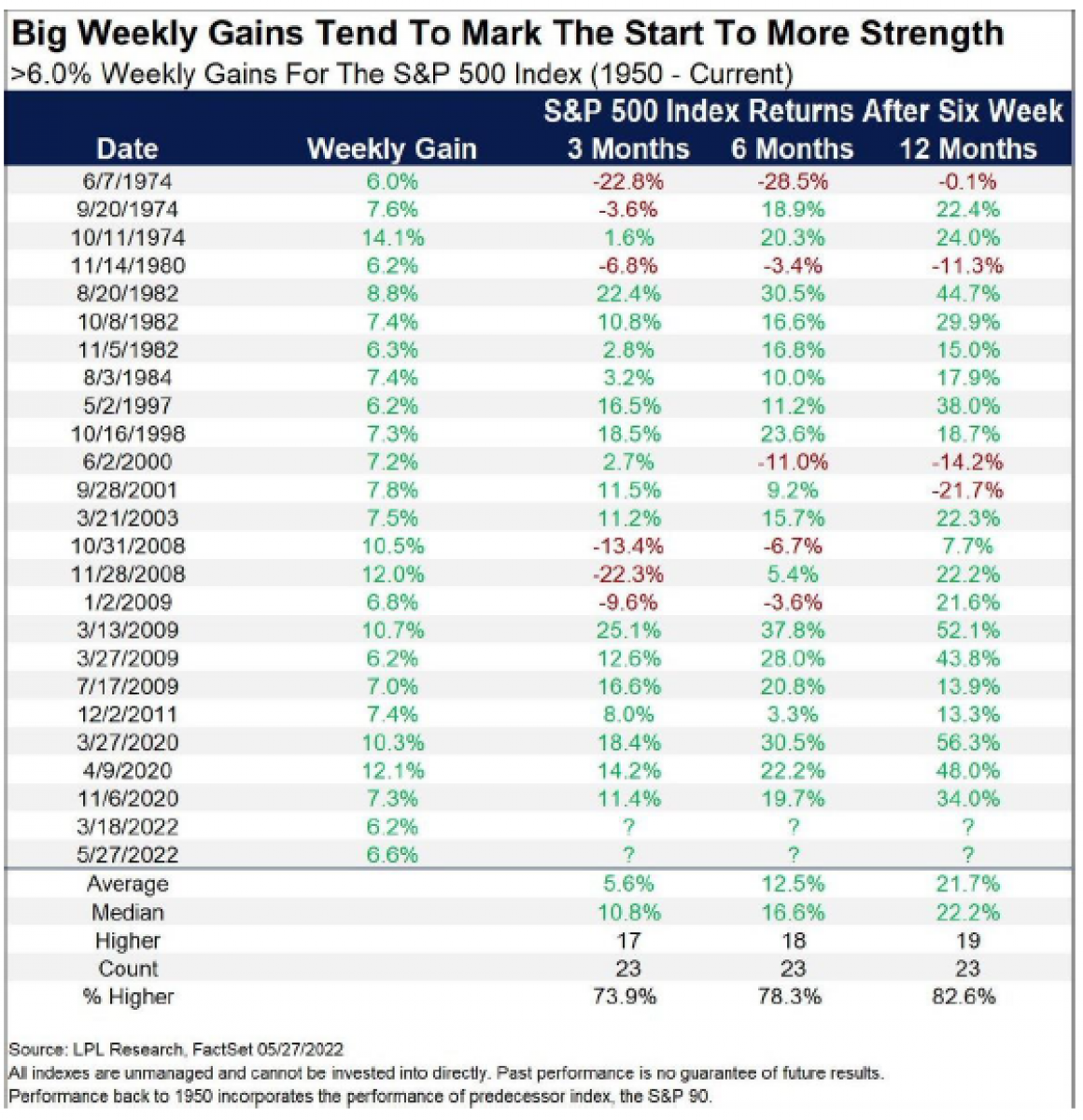

Image: Callum Thomas

We come from a strong oversold, from a cosmic pessimism. Therefore, a technical rebound can be normal. As can be seen from the image above, in the face of important weekly gains, the markets almost always continue to rise in the wake of the momentum.

It's hard to say if this will be the case again, but the important thing is to always do what is called a scenario analysis: it tells us first how we should behave with our investments, depending on whether scenario "A" occurs rather than scenario "B".

In this way, having a strategy, we will always know what to do and we will never be at the mercy of the markets. Trying to predict the future is almost always bad for our money.

Related articles

Related articles

Is there a light at the end of the tunnel? The answer is “yes,” because any crisis has not only a beginning but also an end. It will be the same this time too.

News 17 February 2023

The company celebrated the partners that have helped enhance access to quality health care for patients most in need.

USA 16 February 2023

The world’s largest provider of health care solutions to office-based dental and medical practitioners will release its fourth quarter and full-year 2022 financial results before the stock market...

Editorials 13 January 2023

The first thing you should do is to try not to panic and move as rationally as possible, leaving emotions aside.

Market 11 March 2022

Author: Luigi Campopiano

The condition of the financial markets seems very negative even if, reading carefully between the lines, it turns out that the war in the past has always represented moments of market growth. Will it...

Read more

Read more

Digital Dentistry 19 November 2025

Increasing awareness of tooth fracture, both complete and incomplete, as a significant disease entity has led to improved diagnostic techniques.

Editorials 19 November 2025

As Ellen Simmons-Shamrell of the Class of 1977 wrote her annual check for the Michael D. Scotti, DMD Endowed Scholarship—established in memory of her late classmate—she reflected on how different...

Products 19 November 2025

Smartee Denti-Technology has unveiled the Smartee Digital Orthodontic Technology Exhibition Hall, a 1,200-square-meter space dedicated to showcasing the company’s innovations in clear aligner...

News 19 November 2025

Coupa, the global leader in AI-powered spend management, today announced a new collaboration with Specialized Dental Partners, a premier dental support organization (DSO) dedicated to enabling its...

News 19 November 2025

Breakthrough T1D has been selected as a 2025 Health Access Hero Award grant recipient by Sun Life U.S. and DentaQuest.