Metaverse: Don't get overwhelmed by the frenzy

Luigi Campopiano

The last frontier of speculation is the "metaverse," a word that today exists in the financial world and beyond. In financial markets, speculations move quickly: in the last two years, we have gone from meme titles to cryptocurrencies to NFTs.

Many people are thinking about investing money in the metaverse. Innovative projects are wrapped in an aura of mystery and the possibility of incredible future opportunities can exert great charm. Beware, however, that "not all that glitters is gold,” as the saying goes. As we just saw in recent days, cryptocurrency markets saw major losses with the collapse of billionaire Sam Bankman-Fried’s FTX exchange. According to news outlets including Forbes, the fallout from FTX’s liquidity crunch may just be beginning, with a federal probe into the company's actions reportedly underway.

In this column, I'll share more about the metaverse and what led to its boom in popularity. For starters, here are two stories to better understand the term.

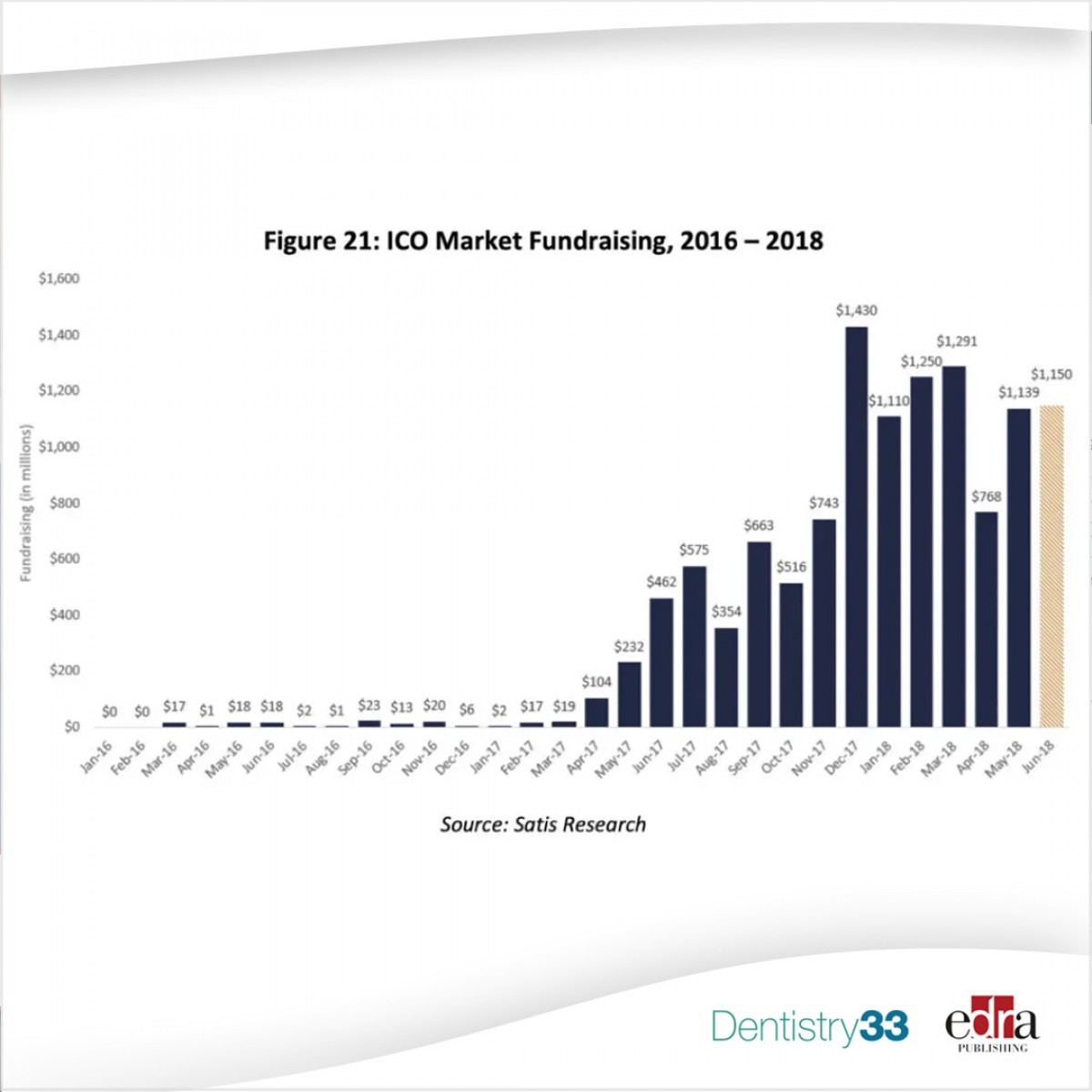

- ICO or Initial Coin Offering. This was an innovative method for startups to use to raise capital. A startup creates a new cryptocurrency or token and puts it up for sale to the public. Those interested in investing in the startup project bought their tokens or cryptocurrency by paying for them with other cryptocurrencies, hoping to earn from the appreciation of their value and the success of the project the startup intended to carry. The capital raised by ICOs went from tens of millions of dollars a year between 2014 to 2016 to a few billion in the period from 2017 to 2018.

The most common feature of ICOs was that they were projects far from being realized or achievable, and the rate of fraud and failure proved appalling. The frenzy of that period led to the launch of a few thousand ICOs, with nearly 85% going south. A 2018 Satis Group study calculated that most ICOs turned out to be scams, failed to implement the proposed project or lost popularity.

On the flip side, some ICOs have become a big hit, like Ethereum which raised capital through an ICO totaling more than $415 million dollars in 2014. It also had incredible percentage performances. Ethereum has become not only one of the technologies underlying one of the main cryptocurrencies, but it is also the basis of an entire ecosystem of crypto assets. But in 2014, no one suspected this would be the case. For a successful project like Ethereum, there have been thousands of rip-offs, Ponzi schemes and fraud of all kinds. Attacks from hackers made ICOs obsolete, causing thousands of promising projects to disappear and losing millions for investors.

- Second Life. In 2003, Linden Lab launched an online virtual world called Second Life. This virtual world could be downloaded for free and explored by anyone after creating an avatar. Users could participate in creating new digital elements.

In the years that followed, there was a boom in interest in the revolutionary aspects and the business potential that a virtual world like Second Life promised. This was true especially after 2006, when the mix between media coverage and private investments pointed out the project could revolutionize the Web. Second Life landed on magazine covers and earned praise from major newspapers and famous brands. The company opened virtual stores to ride that revolutionary wave.

Another interesting factor in Second Life was its currency, Linden dollars, which could be converted into real dollars on the official LindeX exchange platform. Second Life has long since ceased to be on the crest of the wave.

To date, it still has one million users, a number that has remained stable over the last 10 years. At some point, companies realized that related business opportunities weren't that lucrative. Many users simply lost interest, diverting their attention to other sites. In addition, some things that happened related to Second Life negatively affected the users’ trust. Ginko Financial, one of the dozens of virtual investment banks born in the world of Second Life, promised investors high returns, but later declared bankruptcy and was considered to be a Ponzi scheme.

Second Life is an ancestor or precursor to the metaverse, and ICOs have a close connection with its basic elements. It is difficult to define clearly because the metaverse does not yet exist, at least not in its complete form. It represents the image of what the Internet will become in the future with the union of several trends already underway in the online world.

The metaverse could one day overcome and replace today's Web, becoming a new digital frontier for virtual life. It could add a parallel digital world to the real world, with business opportunities that could multiply: The more time you spend in the digital world, the stronger your urges may become to buy and consume products and digital content.

This may sound farfetched, but we already see similar phenomena in several video games. To date, it is estimated that the expenditure made by players for virtual goods is more than $80 billion dollars. Market analysts are estimating the volume of business that could turn around the metaverse in the future, amounting to trillions of dollars. Many leading companies already seem to be moving in that direction.

When we talk about the metaverse, we include blockchain, cryptocurrencies, NFT, and many other forms that the digital world has taken, as these assets are closely linked. The popularity of one influences the others; the metaverse has found fertile ground after two years that saw the explosion in the value of cryptocurrencies and the number of projects created starting from blockchain technology such as NFTs.

Keep in mind that there is also the great risk that the value of all these virtual assets will go to zero. When you think about investing in them, you need to keep this in mind.

Only in recent months have crypto assets lost much value. There have also been scams and digital thefts costing investors hundreds of millions of dollars. The greatest dangers and the great opportunities of any tool that enters a hype cycle remain essentially the same: businesses that could revolutionize a sector, service or product and projects that sometimes turn out to be too extravagant and murky lose their popularity.

An investment in the metaverse should be treated like all other investment decisions concerning other assets. Know the characteristics of that asset and investigate the role they play in the portfolio; do not enter with all the financial assets.

The keyword of any investment portfolio is diversification; do not be guided by love or hatred towards an instrument when making investment decisions.

Whatever the future of the metaverse, the way of dealing with very volatile alternative investments does not change. Invest in limited shares of the capital. With that approach, when those speculative assets are good, they can provide a nice return. When they go bad, you do not end up in ruin.

Related articles

Related articles

The trend of the future that no one will be able to do without could have arrived, and the protagonist could be the metaverse. This is a term used to indicate parallel and completely virtual...

News 30 October 2025

GTCR, a leading private equity firm, announced the simultaneous signing and closing of a strategic, structured minority investment in Solmetex (the “company”).

vVARDIS, a Swiss high-growth dental company, and OrbiMed, a leading healthcare investment firm, recently announced the closing of a $35 million financing.

Smile Partners USA (“Smile Partners” or the “company”), a portfolio company of Silver Oak Services Partners LLC (“Silver Oak”), announced today a strategic investment from a new...

Market 29 November 2024

In financial markets, the butterfly effect is not uncommon—a phenomenon where small changes in conditions can lead to significant long-term variations in a system's behavior.

Read more

Read more

Digital Dentistry 19 November 2025

Increasing awareness of tooth fracture, both complete and incomplete, as a significant disease entity has led to improved diagnostic techniques.

Editorials 19 November 2025

As Ellen Simmons-Shamrell of the Class of 1977 wrote her annual check for the Michael D. Scotti, DMD Endowed Scholarship—established in memory of her late classmate—she reflected on how different...

Products 19 November 2025

Smartee Denti-Technology has unveiled the Smartee Digital Orthodontic Technology Exhibition Hall, a 1,200-square-meter space dedicated to showcasing the company’s innovations in clear aligner...

News 19 November 2025

Coupa, the global leader in AI-powered spend management, today announced a new collaboration with Specialized Dental Partners, a premier dental support organization (DSO) dedicated to enabling its...

News 19 November 2025

Breakthrough T1D has been selected as a 2025 Health Access Hero Award grant recipient by Sun Life U.S. and DentaQuest.