The Value of Constraints

Luigi Campopiano

Constraints have value. But what kind of constraint are we talking about? The liquidity (or liquidability) of financial instruments—the ability to cash out an investment through a direct sale on the secondary market—has over time become an almost assumed characteristic of (almost) all managed savings products.

In the financial planning phase first, and in asset allocation later, the financial advisor poses the usual question to the client: “For how many years do you think you can invest your money?” This aims to understand, and make the client understand, whether those funds can be invested in instruments that require a certain period to yield benefits. This question is also present in profiling questionnaires. However, once it’s established that the client is willing to invest in the medium to long term, it’s often added that, by investing in funds/ETFs, they always have the possibility to reclaim their money by requesting a refund and obtaining a payout within a few days. But if it’s planned that part of the client’s assets should be invested for the medium to long term, especially to meet vital future needs, wouldn’t it be better to impose a precise constraint? If, as they say, investments in markets (especially equity markets) yield the best results for those who have the discipline and patience to wait, why offer the option to exit prematurely? If the client might need the money in an emergency, the asset allocation should already include an adequate liquidity portion for emergencies.

The idea of a constraint is (genetically) ingrained in the minds of many savers. Sophists in the field would call it mental accounting; dividing and segregating one’s financial resources to allocate them to different life goals, especially fundamental ones: the daughter’s dowry, the money for the grandson’s studies, the pension. A form of artisanal financial planning, but effective nonetheless. Yet today, there is a tendency to prioritize liquidity, often even in the form of “do it yourself”: you buy a financial instrument and sell it with a click (a terrible trend). Constraints can lead to better investment discipline and greater rationality over time (e.g., less panic selling).

If constraints have value, what solutions can more or less effectively create them? We can distinguish between two schemes in this regard:

Legal-Contractual Constraint:

- This includes pension products (although there are cases where it is possible to cash out part of the money in the plan, the amounts are tied to meeting legal requirements, shifting the focus of investors significantly: few of them likely looked at the performance of their pension fund during the first horrible half of the year. Even better if the pension product is opened for children/grandchildren at a young age), PIR (other instruments that legally impose a constraint, though in a softer way: sellable at any time but at the cost of losing tax benefits if done before the required five years), and illiquid funds (solutions that contractually, and sometimes necessarily, impose a constraint: they invest in unlisted assets, insurance products that include initial lock-up periods, and higher up, investments in specific projects “club deals” or forms of venture capitalism. It’s also worth noting that real estate traditionally imposes a significant temporal constraint).

Emotional-Behavioral Constraint:

- Here, the advisor's ability to use the right levers comes into play (unfortunately or fortunately, this is necessary for sound and correct financial planning and portfolio optimization: emotions often play nasty tricks). For example, a simple SIP still creates a constraint/incentive in the client’s mind to stay invested, even during crises. Financial planning is inherently a suitable solution for creating constraints if the importance of reaching specific goals is adequately emphasized by the advisor: “You don’t want your child to miss out on college, do you?!” “You don’t want to leave your heirs in financial difficulty, do you?!”

Related articles

Related articles

News 27 June 2024

Prevention is to be considered the most significant tool for involving the assisted person in being the responsible protagonist of his or her lifelong health project.

Editorials 28 March 2024

At UF Health, we bridge discoveries with clinical care, leading to new advances that offer hope and healing for our patients and their loved ones.

News 17 May 2023

The decrease included a 3.7% decrease in local currencies excluding acquisitions, 1.4% growth from acquisitions and a 1.5% decrease related to foreign currency exchange.

Market 12 August 2022

The global marketplace for medical supplies is anticipated to reach a value of $163.5 billion in 2027, according to a report from market research company, MarketsandMarkets. The 2022 value of the...

Read more

Read more

Much like EMTs rushing to the scene after an accident, stem cells hurry to the site of a skull fracture to start mending the damage. A new finding has uncovered the signaling mechanism that triggers...

Products 05 November 2025

SimplyTest has launched a groundbreaking saliva-based test to detect high-risk strains of oral human papillomavirus (HPV), a major cause of oropharyngeal cancers.

News 05 November 2025

Perimetrics, Inc., a dental technology company pioneering quantitative diagnostics, announced today that the U.S. Food and Drug Administration (FDA) has granted clearance for the InnerView...

News 05 November 2025

On October 15, open enrollment for Medicare began nationwide. Hundreds of thousands of seniors in New Jersey will once again face the challenge of finding the right Medicare coverage, including the...

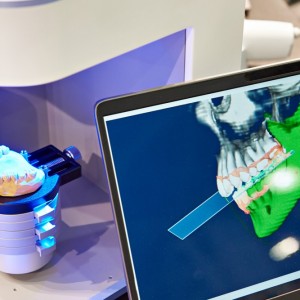

Digital Dentistry 04 November 2025

Digitalisation is an expanding field in dentistry and implementation of digital teaching methods in dental education is an essential part of modern education.