Odne Announces Closing of Series A1 Financing Round to Fund the US Market Launch

Odne Ltd, a Swiss dental start-up company and upcoming innovator in endodontic treatments, is pleased to announce the closing of its Series A1 Financing Round raising USD 5.5 million (CHF 4.8 million) to fund the upcoming US market launch. Odne’s game-changing technology platform for Root Preservation Therapy (RPT) is expected to transform endodontics. The Odne RPT workflow introduces three new medical devices enabling minimally invasive root canal cleaning and light-cured obturation.

The Series A1 round is led by Revere Partners (NY), an independent venture fund providing capital for cutting-edge innovations in oral and systemic health, and NV Capital (LIE), a family-owned venture capital boutique. Alongside the lead investors, several other renowned funds such as Dental Innovation Alliance (DIA), Plug&Play, Hatcher, Zürcher Kantonalbank, as well as various family offices and angel investors are backing Odne’s US market launch.

“With over 15 million root canal treatments per year, the US is the biggest market worldwide and our number one focus. Currently, we are performing a Priority Access Program to deepen the use of our products with selected US key opinion leaders. At the annual meeting of the American Association of Endodontists (AAE) in April in Los Angeles, we will introduce the Odne RPT workflow solution to the endodontic community,” states Dr. Andreas Schmocker, CEO & co-founder, Odne.

“Odne is within the core investment focus of Revere Partners: innovations in oral health. After receiving FDA clearance for Odne Cure and Odne Fill in 2023, the series A1 financing fuels Odne’s US market launch to the endodontic community. Together with all investors, Revere Partners is proud to elevate Odne’s RPT workflow for the benefit of patients, endodontists, and the referring general dentists,” adds Dr. Jeremy Krell, managing partner, Revere Partners.

About Odne

Odne (Onde Ltd and Odne Inc) is a Swiss-US dental startup that has its roots in a groundbreaking collaboration between two renowned universities: the Swiss Federal Institutes of Technology in Lausanne and Zürich (EPFL & ETH Zürich). Founded in 2018, Odne’s journey began by licensing cutting-edge technology assets from these esteemed institutes.

Odne represents a harmonious synergy of Swiss precision and academic excellence. Our company is committed to pioneering the future of endodontics through advanced technology and innovative solutions. Endodontics, the field of dental medicine that deals with root canal treatments, has been marred by complexity and unpredictability. Odne AG is on a mission to change that.

Root canal treatments have long posed challenges for dentists, with traditionally low success rates ranging from 46% to 91%. With over 60 million annual treatments worldwide, these failures result in significant healthcare costs.

Odne’s technology platform addresses these issues by offering treatment options for both dentists and their patients. Our products, slated for launch in 2024, tackle problems such as debridement and obturation in complex root canal morphologies.

About Revere Partners

Revere Partners is the first and only venture capital fund globally focused on investing in oral health technology. Revere invests in cutting-edge and innovative dental technology companies that improve the lives of dental patients and providers through advancements in science and technology.

Revere Partners invites new accredited investors to join the fund and enables startups to connect with unrivaled industry resources and growth opportunities. Founded by Dr. Jeremy Krell and David Arena, Revere Partners fosters strategic partnerships that improve care delivery as well as patient and provider experiences—maximizing value for investors.

About NV Capital

N & V Capital is a family-owned venture capital boutique focused on European investments in various sectors such as Fintech, MedTech, and Digital Health. With generations of entrepreneurial experience, N & V seeks scalable ventures driven by technology or scientific progress.

The boutique brings its own entrepreneurial experience to the table and offers its extensive network and expertise to visionary founders seeking sustainable growth for their companies. Although N & V Capital invests up to Series A, the main focus is on early-stage investments.

Source: www.reverepartnersvc.com

Related articles

Related articles

Andreas Schmocker, CEO of Odne, proudly announces the appointment of Steve Fanning as an independent board member.

The Center for Oral Health (COH) is proud to announce the release of its newest white paper, Health Equity in Oral Health: Moving Beyond Equality to Justice.

Archy, a pioneer of cloud-based automation software for dental practices, today announced it has raised $15M in Series A funding in a round led by Entrée Capital, with participation from Bessemer...

Products 13 August 2024

Heartland Dental and Concorde Career Colleges Unveil Groundbreaking Dental Education Collaboration

Concorde Career Colleges, the healthcare education division of Universal Technical Institute, Inc., and Heartland Dental yesterday announced a first-of-its-kind partnership to develop a co-branded...

Kwikly Dental Staffing is proud to announce the successful completion of its Series A fundraising round, driven by an investment from Heartland Dental and a dedicated investor network

Read more

Read more

Digital Dentistry 30 September 2025

Diagnosis and Treatment Planning for Predictable Restorative Outcomes

The dilemma in comprehensive dentistry is that dentists are often focused on restoring teeth for esthetic outcomes, and if occlusion is not taken into account during diagnosis and treatment planning,...

Editorials 30 September 2025

At Adams School of Dentistry, faculty and staff members often say their favorite part of working here is the people.

Products 30 September 2025

Dentsply Sirona is excited to announce the upcoming launch of an expanded AI-powered CEREC workflow and new milling units¹: CEREC Primemill Lite and CEREC Go, aimed at making Single Visit Dentistry...

News 30 September 2025

Gladwell Practice Solutions (GPS), founded by Dr. Jason Gladwell, a leading Invisalign System provider, is proud to announce the launch of GPS Premium, a new learning management program designed to...

News 30 September 2025

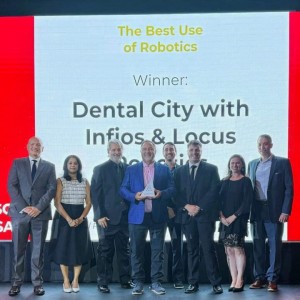

Dental City, a leading U.S. distributor of dental supplies, today announced that it has been named the winner of the Best Use of Robotics category at the Supply Chain Excellence Awards USA in Miami.

D5border.jpg)